eTax Guideline

eTax Guideline

How to submit Domestic Income Tax

“We highly recommended you to come to tax authority for assisting”

Click here (PDF Version) if you want to download PDF version

Preparation before Submitting Domestic Annual Income Tax:-

- You must have an e-Tax Account

- Verified all the monthly income paid and been fully capture in the SIGTAS system, you can verify directly in Account Module in e-Tax

- Must list all the income and expenses for whole year (ex:01 January till 31 December 2024)

- Data for Profit /Loss, Balance sheet & Cash Flow must be ready

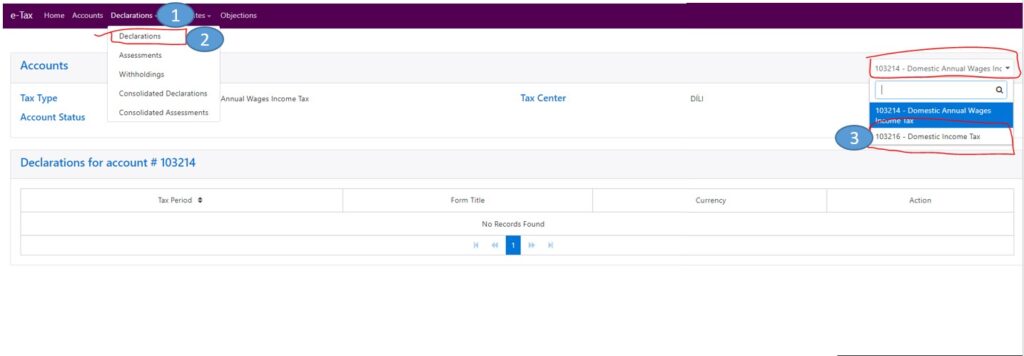

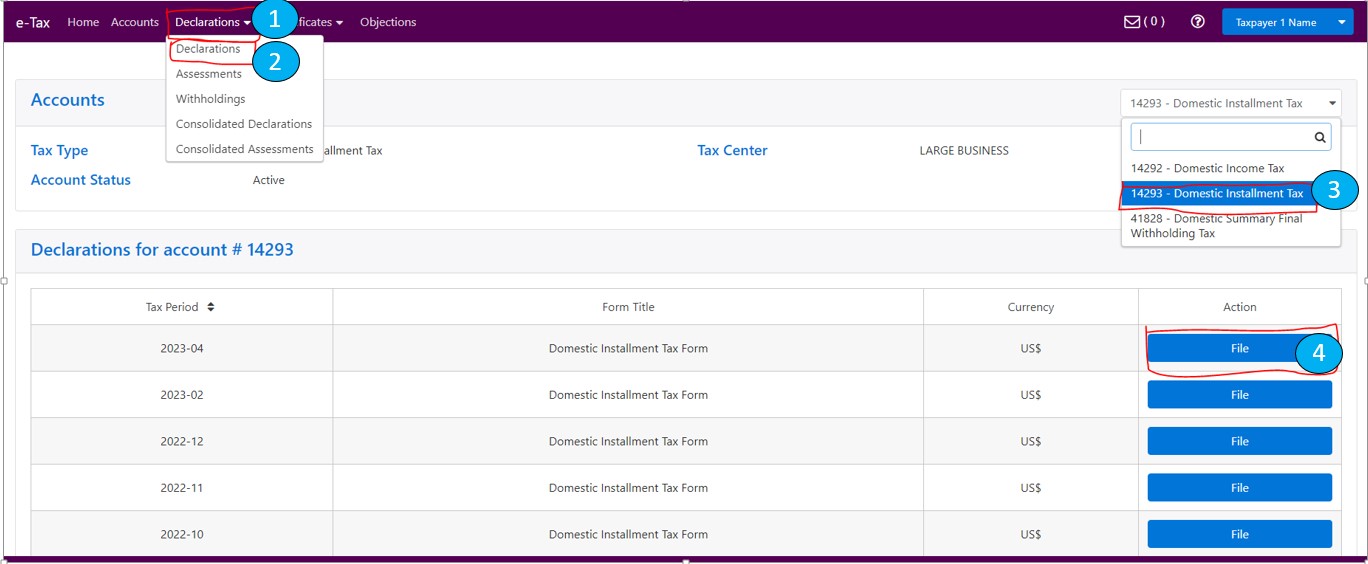

- To submit Domestic Income Tax, click onDeclarations in the toolbar and you can see the drop-down menu

- Click on Declaration

- Go to the search field on the right and use the navigation arrow (Ú) to select Domestic Income Tax

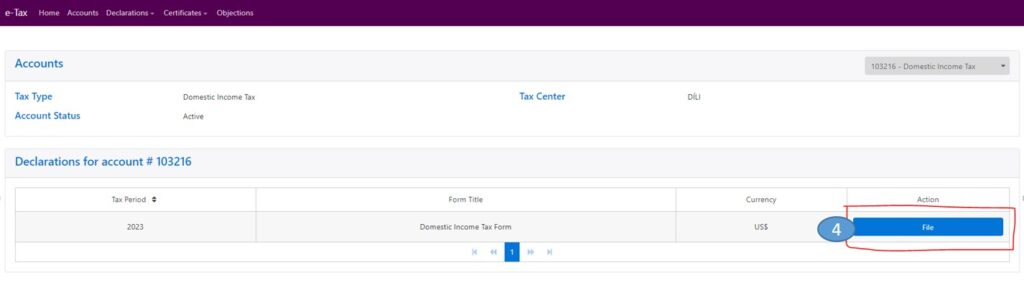

- Click File for the annual that you want to submit (Please note that Domestic Income Tax 2023 is just an example for this guideline).

- Fill the field line from Line 1 up to Line 110 which is based on your company activities. This means that you don’t have fill all the line, and also note that some lines are not visible, example line 135 (this is subtract between line 5 - (10+11)) and those lines will automatically calculate base on number that you put on the linking lines.Please, read the Tax Annual guidelines forms in website attl.gov.tl before filling each lines column direct into the E-Tax platform

- Line 1 Are you an individually owned Enterprise?

- Line 2 Are you an individual Enterprise and a resident of East Timor

- Line 3 Non-resident indicator calculation

- Line 5 GROSS_INCOME:

- Line 10 Purchases-Inventory and Trading Stock

- Line 15 Tax-deductible Depreciation

- Line 20 Tax-deductible Amortization of Intangibles

- Line 25 Tax-deductible Bad Debts

- Line 30 Tax-deductible Foreign Currency Exchange Losses

- Line 35 Salary and Wages

- Line 40 Contractor and Sub-Contractor Expenses

- Line 45 Commission Expenses

- Line 50 Rent Expenses

- Line 55 Motor Vehicle Expenses

- Line 60 Repairs and Maintenance

- Line 65 Research and Development Expenses

- Line 70 Scholarship, Apprenticeship, and Training Costs

- Line 75 Royalties

- Line 80 Losses from Sale/Transfer of Business/Income Property

- Line 110 Other Tax-deductible Expenses

- Line 135 TOTAL EXPENSES

- Line 140 Net Income/Loss before deducting or adding carry forward losses

- Line 145 Loss carried forward from previews year or last year

- Line 150 Year Taxable Income or Loss

- Line 155 Total Losses to carry forward to next year

- Line 160 INCOME SUBJECT TO TAX this year

- Line 165 TAX ON INCOME SUBJECT TO TAX this year

- Line 170 Foreign tax credits

- Line 175 Income tax instalments paid

- Line 180 Withholding Tax withheld from royalty income received

- Line 185 Withholding Tax withheld from rental income received from land and/or buildings

- Line 190 Withholding Tax withheld from building and construction income

- Line 195 Withholding Tax withheld from construction consulting services income

- Line 200 Withholding Tax withheld from air and sea transportation services income

- Line 205 Withholding Tax withheld from mining and mining support services income

- Line 215 Total credits

- Line 220 Tax owing/overpaid

- Line 225 INCOME TAX OWING

- Calculate and make sure the value numbers input for all lines in columns are correct, if same line fill is not correct need to correct value or amount , please click reset . and do the correction, click calculate bottom again and

- Click Save

- Before Click Submit Declaration, you must attached all the supporting document such as: Profit /Loss, Balance sheet & Cash Flow and other specific line ; 15, 50 and 110

- Click Submit Declaration

NOTE:

ALL of the income for the company received was subject to proper Withholding and the company elects FINAL WITHHOLDING in line of filing an Income Tax Return during the year Just enter Zero amount on the first line is calculate and submit IF THE TYPE OF SERVICES PROVIDED BY THE COMPANY (CHECK APPLICABLE):-

- Please to read: Tax Guide Annual Income line: 195-205

- Carrying on construction or building activities (2%)

- Providing construction consulting services (4%)

- Providing air or sea transportation services (2, 64%)

- Carrying on mining or mining support services (4, 5%)

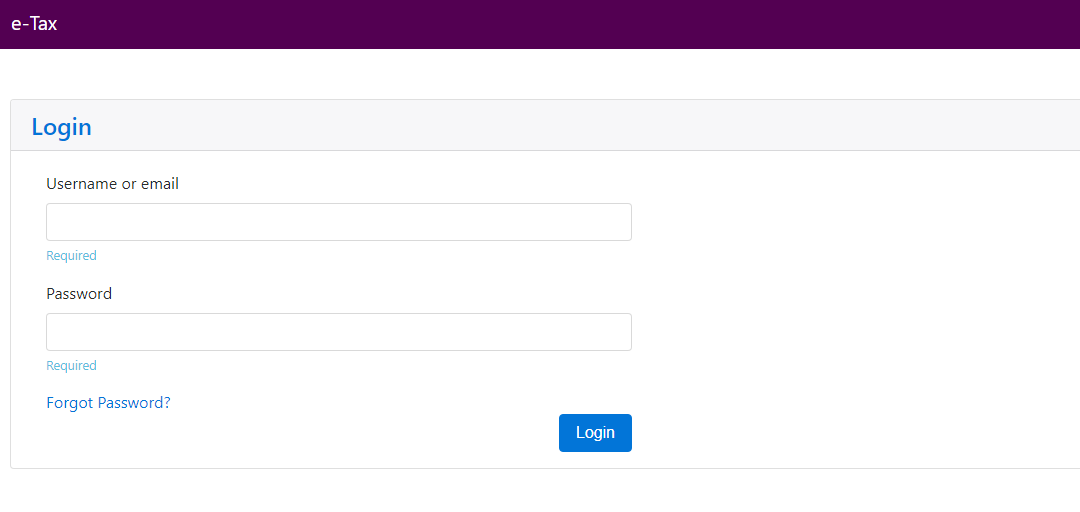

- Visit Tax Authority Website on https://attl.gov.tl/

- Click on e-Tax Login

- Insert your credential (Username or email and Password ) that has registered in Tax Authority

- Click Login

Click here(PDF Version) if you want to download PDF version

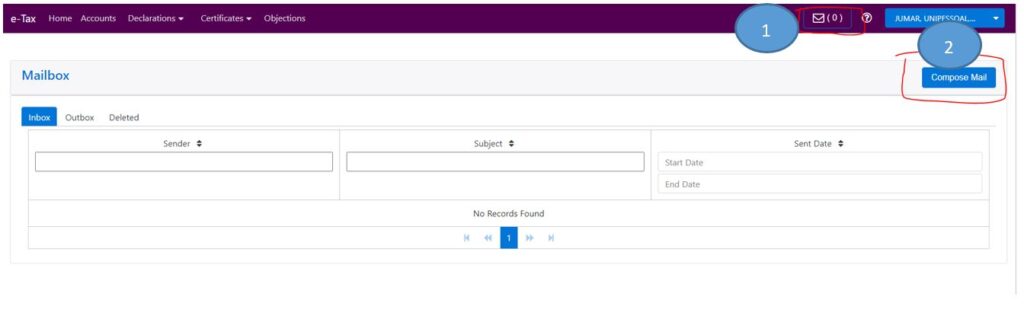

Click here(PDF Version) if you want to download PDF version  Fill the required fields if needed (see the sample and description as Bellow);

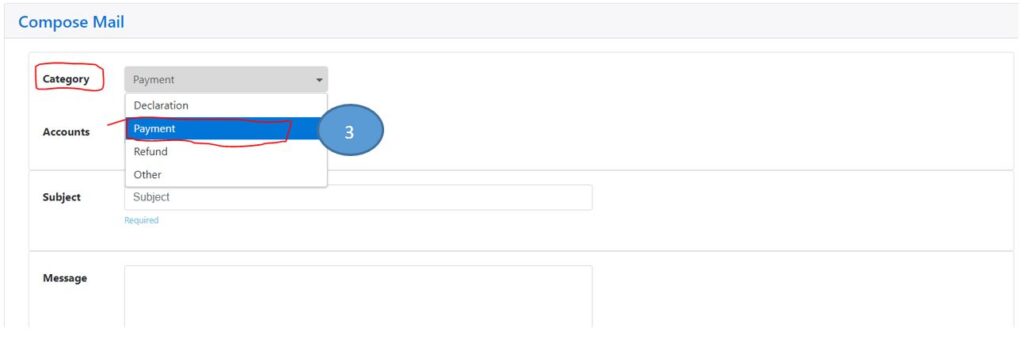

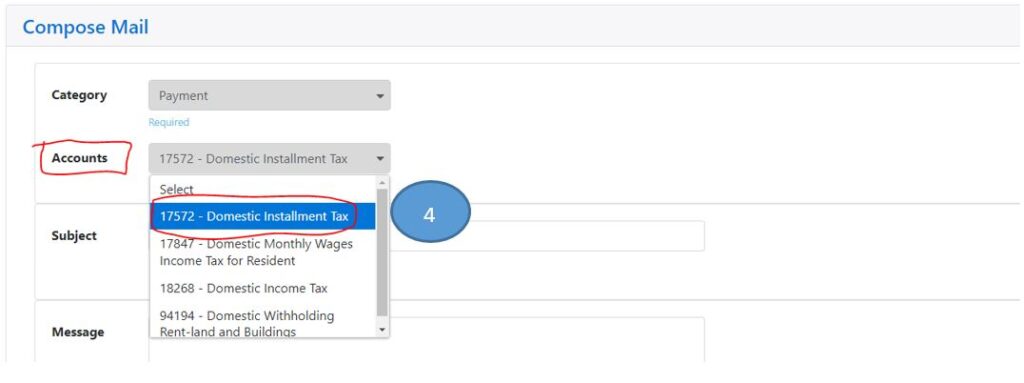

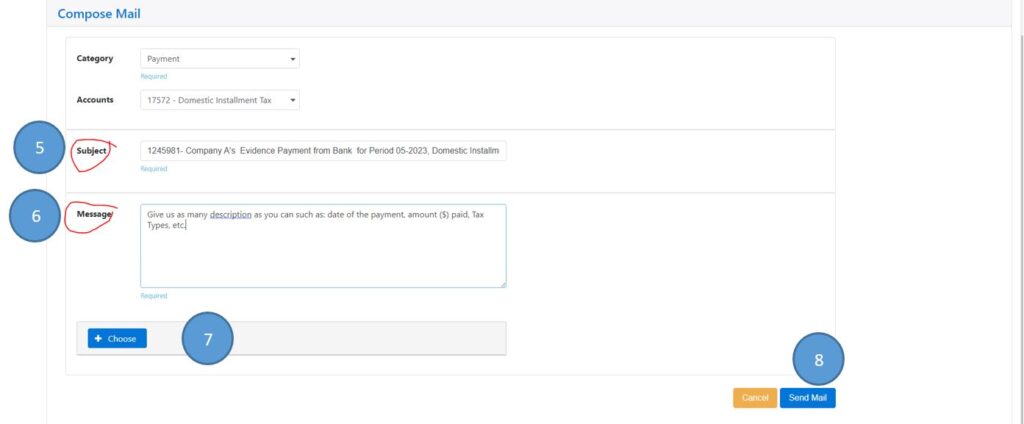

Fill the required fields if needed (see the sample and description as Bellow);

- Category: Go to the search field to use the navigation arrow (Ú) and select/Choose Payment

- Accounts: Go to the search field to use the navigation arrow (Ú) and select/Choose specific Tax types that made the payment for (12623 - Domestic Installment is example for this guideline), or you can leave it for those who use the manual form.

- Subject : start fill the column with the TIN number and Description of the Evidence (Example: 1245981- Company A's Evidence Payment from Bank for Period 05-2023, Domestic Installment Tax)

- Message: if payment is more than one tax types, Give us as many description as you can such as: date of the payment, amount ($) paid, Tax Types, etc.

- Click on Choose (File needed to be scanned into your computer or devices)

- Click Send

Click here(PDF Version) if you want to download PDF version

Click here(PDF Version) if you want to download PDF version - To submit Domestic Installment Tax, click onDeclarations in the toolbar and you can see the list of the drop-down menu

- Click on Declaration

- Go to the search field on the right and use the navigation arrow (Ú) to select Domestic Intallment tax

- Click File for the prefer month that you want to submit (Please note that 2023-04 is just an example for this guideline).

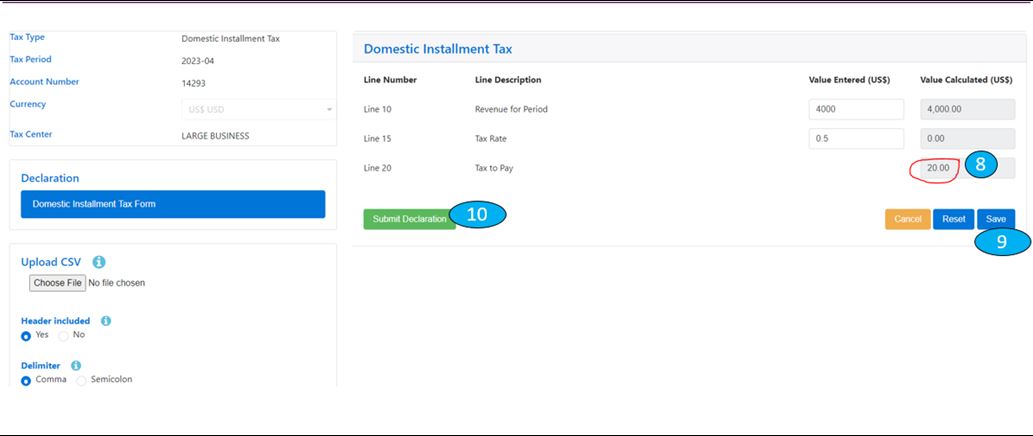

Fill the required fields in the right section if needed;

Fill the required fields in the right section if needed;

- In “Line 10 Revenue for Period”: Insert Total Gross Amount in the Column ($4000 is example for this guideline)

- In “Line 15 Tax Rate”: the system will calculated automatic for tax the rate of 0.5% from gross amount base on the “line 10”.

- Click Calculate

- Amount ($) for “Line 20 Tax to Pay” will be automatically display once we click the Calculation Button ( $4000X0.5%=$20 is example for this guideline or you can click reset if there some mistake with the Amount)

- Click Save

- Submit Declaration

Click here(PDF Version) if you want to download PDF version

Click here(PDF Version) if you want to download PDF version - Domestic Monthly Wages Income Tax for Resident/ Imposto Salarios ba Funsionarios Residente,

- Domestic Monthly Wages Income Tax for non- Resident/ Imposto Salarios ba Funsionarios Naun-Residente, no

- Domestic Service Tax/Imposto Servisus.

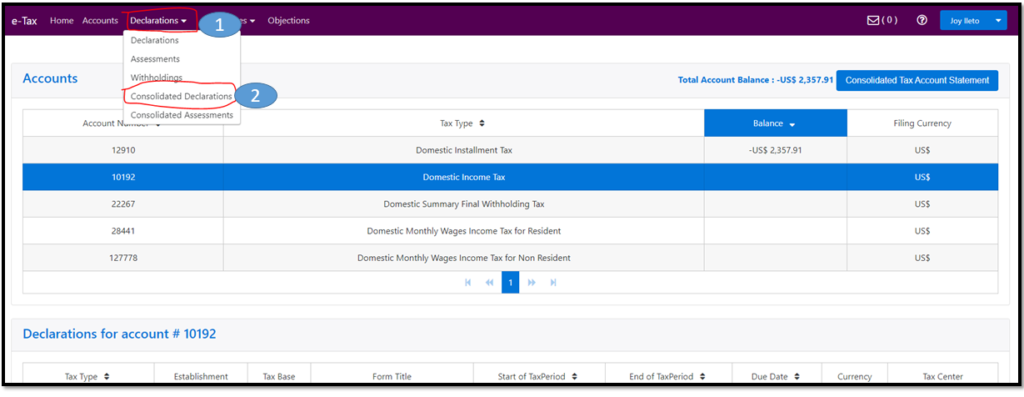

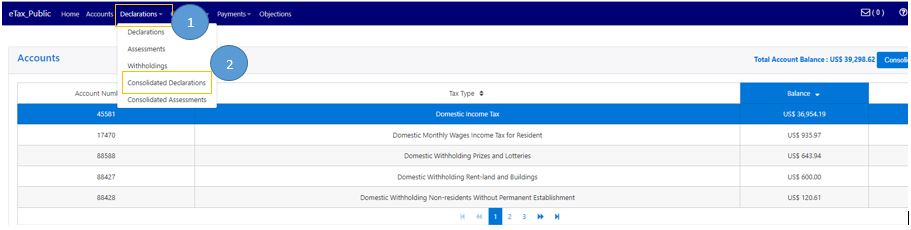

Step 1). Submete Domestic Monthly Taxes, Klik iha Declarations iha menu no bele hare lista drop-down menu hanesan imajen.

Step 2). Klik iha Consolidated Declarations

Step 3). Ba iha search field/buka parte klaran uza seta navegasaun /navigation arrow (Ú) Hili Domestic Monthly Taxes

Step 4. klik File ba fulan/tinan neébe prefere atu submete deklarasaun mensal (Favor note iha 2023-05 neé ezemplu deit ba mata-dalan neé). Antes ba step 5, ita-boót sira mos tenki hatene/kumpreende katak Domestic Monthly Taxes neé akumula tipo Imposto tolu (3) mak hanesan a)Domestic Monthly Wages Income Tax for Resident, b)Domestic Monthly Wages Income Tax for non- Resident, and c)Domestic Service Tax. Tipo imposto sira neé balun sei la mosu iha drop-down menu neé tanba sei bazea ita-boót sira nia atividades negosio/Business Activity (ex: karik empresa/kompaña la emprega/ la iha Funsionariu Naun-Residente /Foreigner employees, ne’e Domestic Monthly Wages Income Tax for non- Resident sei la mosu iha lista tipo imposto).

Antes ba step 5, ita-boót sira mos tenki hatene/kumpreende katak Domestic Monthly Taxes neé akumula tipo Imposto tolu (3) mak hanesan a)Domestic Monthly Wages Income Tax for Resident, b)Domestic Monthly Wages Income Tax for non- Resident, and c)Domestic Service Tax. Tipo imposto sira neé balun sei la mosu iha drop-down menu neé tanba sei bazea ita-boót sira nia atividades negosio/Business Activity (ex: karik empresa/kompaña la emprega/ la iha Funsionariu Naun-Residente /Foreigner employees, ne’e Domestic Monthly Wages Income Tax for non- Resident sei la mosu iha lista tipo imposto).

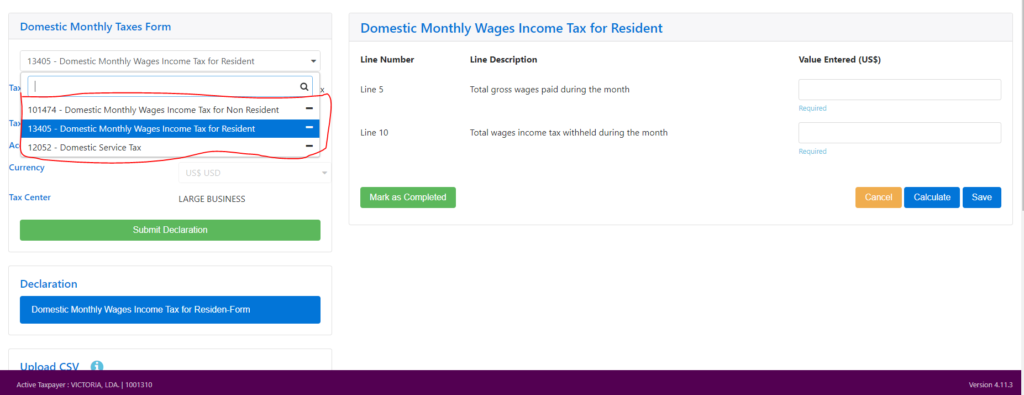

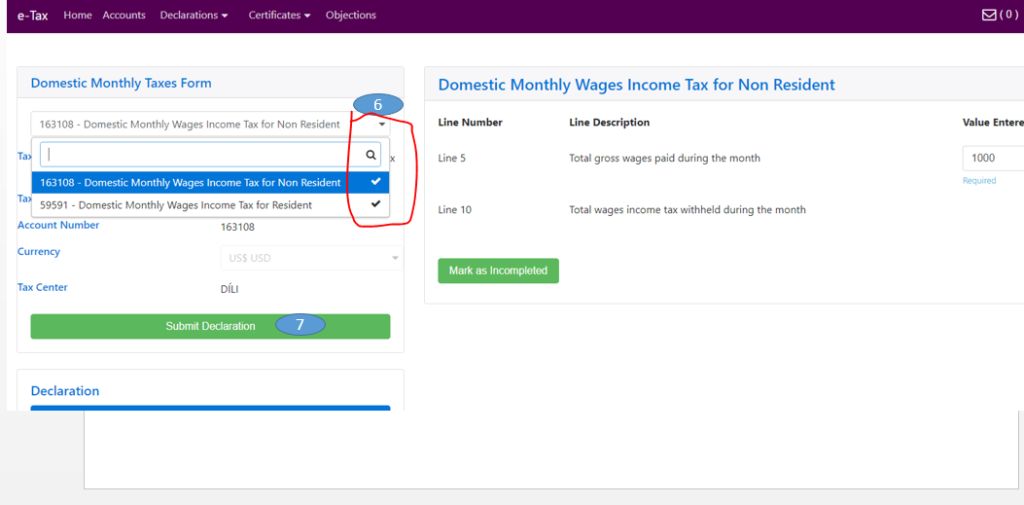

Step 5). Ba iha search field/ kampu parte karuk no uza panah/navigation arrow (Ú) hodi hili tipo Impostos/taxes types lista drop-down menu neébe ITA hakarak atu deklara /submete:

I. Domestic Monthly Wages Income Tax for Resident / Imposto Salarios ba Funsionarios Residente

I. Domestic Monthly Wages Income Tax for Resident / Imposto Salarios ba Funsionarios Residente

-

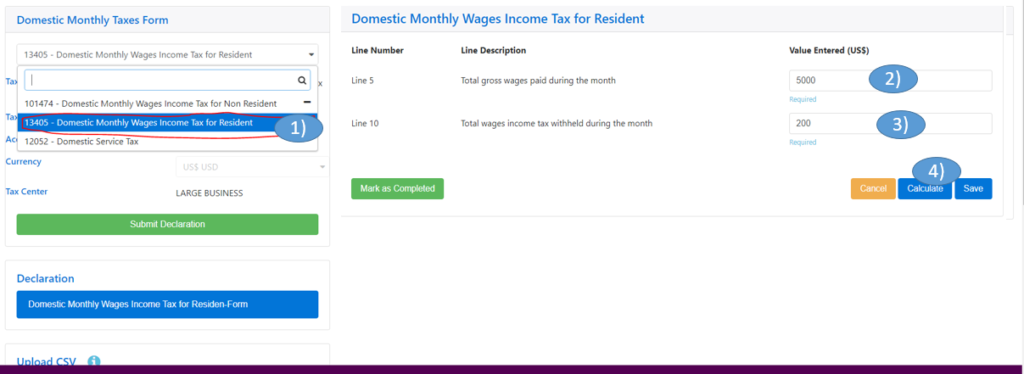

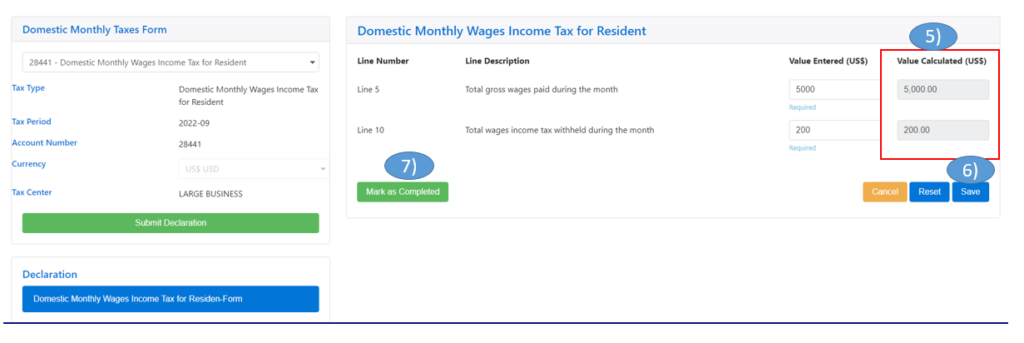

- Ba iha search field/kampu parte karuk hodi uza seta navegasaun/navigation arrow (Ú) hodi hili Domestic Monthly Wages Income Tax for Resident

- Preenxe tuir kuluna neébe iha seksaun parte loos nian karik presiza; iha “Line 5”: insera Total gross wages paid during the month iha kuluna ($5000 hanesan ezemplu ba mata-dalan ida-neé), favor vizita / kontatu ami karik atu hatene liu tan informasaun.

- Iha “Line 10 Total wages income tax withheld during the month” ba kuluna ida-neé kalkulasaun manual depende ba tabela salarios neé empresa/kompaña oferese ba funsionarios iha kompaña (total $200 ba Imposto salario funsionarius hotu maibe funsionarios ne’ebe sira nia liu >$500 ida-ne’e hanesan ezemplu ba Mata-dalan ida-ne’e).

- Klik iha Calculate

- Kuluna ho Montante ($) ba “Valor Calculated (US$)”(5000 ba liña 5 no 200 ba liña 10 )sei automatika mosu depois klik Calculate Button (Ita-boót sira bele klik reset karik montante insera ne’e sala ($.

- Clik Save

- Klik Mark as Complete

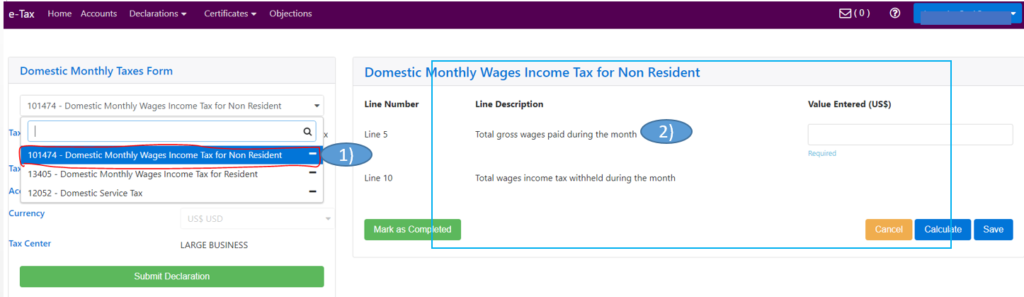

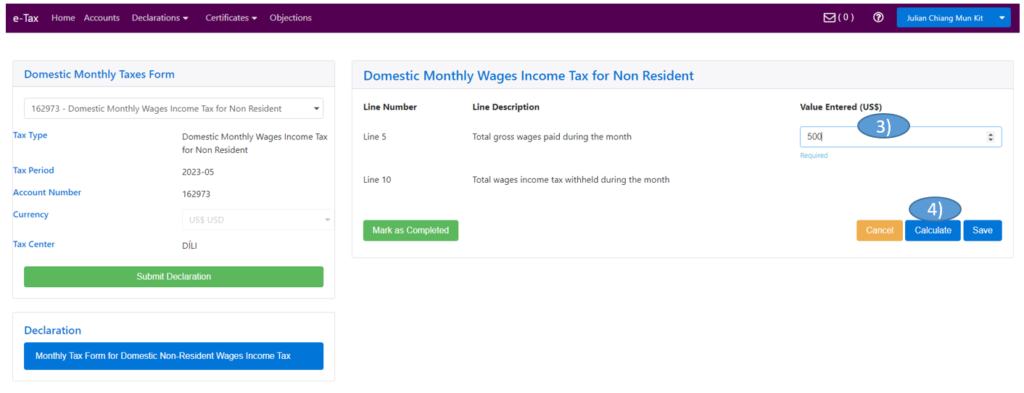

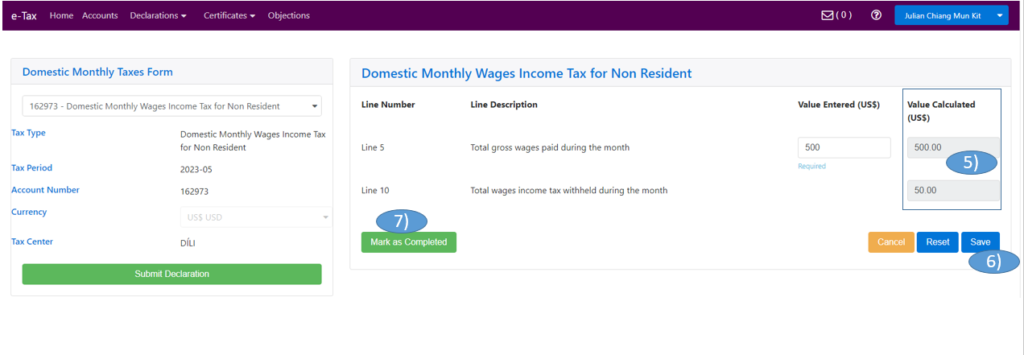

II. Domestic Monthly Wages Income Tax for non- Resident / Imposto Salarios ba Funsionarios Naun-Residente

-

- Ba iha search field/kampu parte karuk no uza seta navegasaun/navigation arrow (Ú) hodi hili Domestic Monthly Wages Income Tax for non- Resident

- Preenxe kuluna neébe requzita/presiza iha seksaun parte loos nian karik presiza;

- Iha “Line 5”: Insera Total gross wages paid during the month iha kuluna ($500 neé hanesan ezemplu ba mata-dalan ida-neé), halo favor kontatu no vizita ami karik presiza liu tan informasaun ruma.

- klik calculate, iha “Liña 10 Total wages income tax withheld during the month” sei automatically mosu wainhira klik iha Calculate Button ( $500X10%=$50 neé hanesan ezemplu deit ba iha mata-dalan ida-neé ou ita-boót bele klik reset karik montante insera ne’e sala($))

- Montante ($) valor/montante ($) iha “Liñe 15 Tax to Pay and Value Calculated (US$)” sei automatically mosu wainhira ITA klik iha Calculate Button ($500 hanesan ezemplu ba mata-dalan ida-neé ou ITA bele klik reset karik montante insera ne’e sala)

- Klik Save

- Klik Mark as Completed

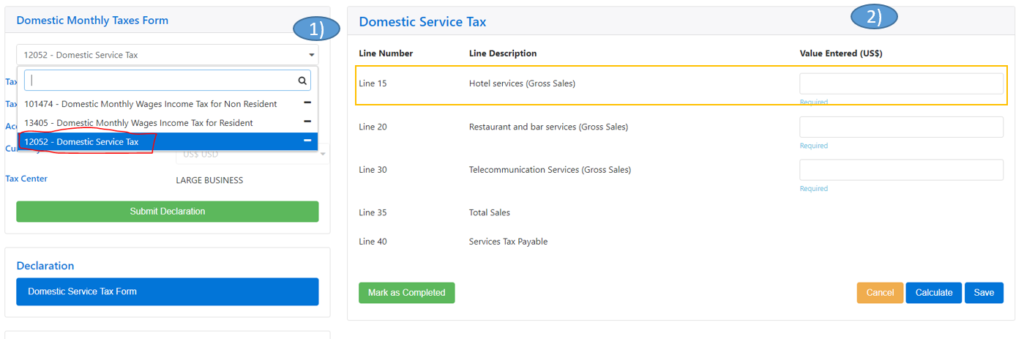

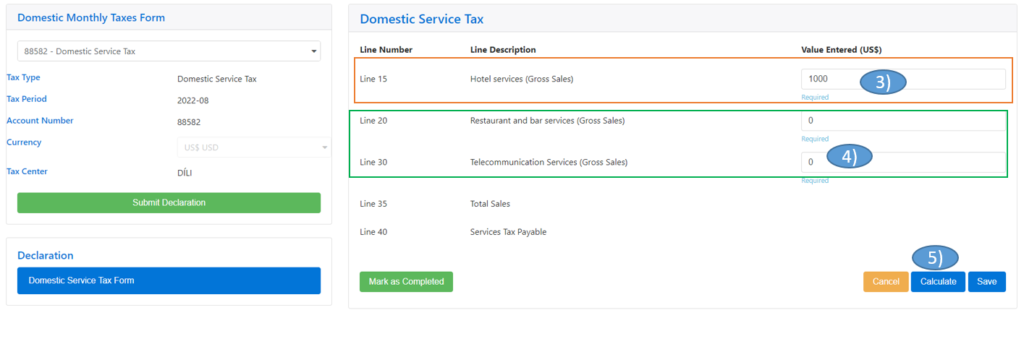

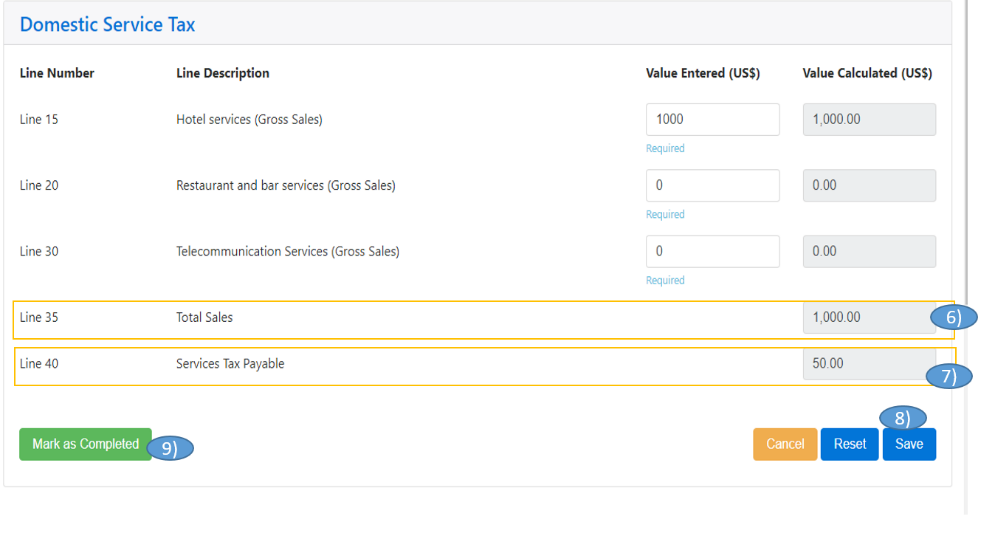

-

- Ba iha search field /kampu parte karuk no uza seta navegasaun/navigation arrow (Ú) hodi hili Domestic Service Tax

- Preenxe Requezito/ fields iha seksaun parte loos servisu spesifiku neébe fornese (fornese Servisu iha area Hotel Services, “Gross Sales” hanesan ezemplu iha mata-dalan ida-neé).

- Iha Liña 15 Hotel services (Gross Sales); Insera total montante groso durante fulan tomak nia laran ( Maio 2023 $1000 hanesan ezemplu iha mata-dalan ne’e)

- Iha matadalan ida-ne’e, ITA Hotel Services “Gross Sales” hanesan ezemplu, Nuneé ita bele insera Zero (0 Montante ba iha liña 20 ho 30, tanba kalkulasaun ba tipo imposto rua (2) nia prosesu hanesan mos iha liña 15 Hotel services (Gross Income/Sales).

- klik Calculate Button

- Liña 35 ne’e Total hamutuk/SUM husi liña 15:20:30 ($1000+$0+$0=$1000).

- Liña 40 Services Tax Payable /, sei automatically mosu wainhira ITA klik iha Calculate Button. ($1000X5%=$50 ne’e hanesan ezemplu iha mata-dalan ida-ne’e ou ITA klik iha reset karik ITA Montante insera ne’e sala)

- Klik Save

- Klik Mask as Complete

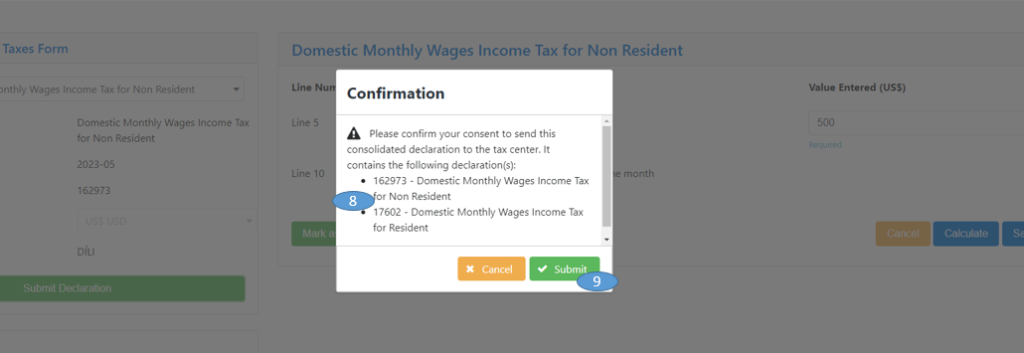

Step 7), Klik Submit Declaration

Step 8), Confirmed list of Consolidated Declaration

Step 9), klik Submit. Husu konfirma antes finalize submisaun deklarasaun no sistema aloka Aumatimente numeru avalisaun / Assessment number kada tipo impostu ho numeru uniku deklarasaun/ a unique declaration number.

Step 8), Confirmed list of Consolidated Declaration

Step 9), klik Submit. Husu konfirma antes finalize submisaun deklarasaun no sistema aloka Aumatimente numeru avalisaun / Assessment number kada tipo impostu ho numeru uniku deklarasaun/ a unique declaration number.

Oinsa Submete Domestic Monthly Final Withholding Tax (Akumulado husi Tipo Imposto hamutuk ualu ( 8 )

Atu submete deklarasaun imposto mensal liuhusi Step sia (9) mak hanesan tuir mai ne’e;

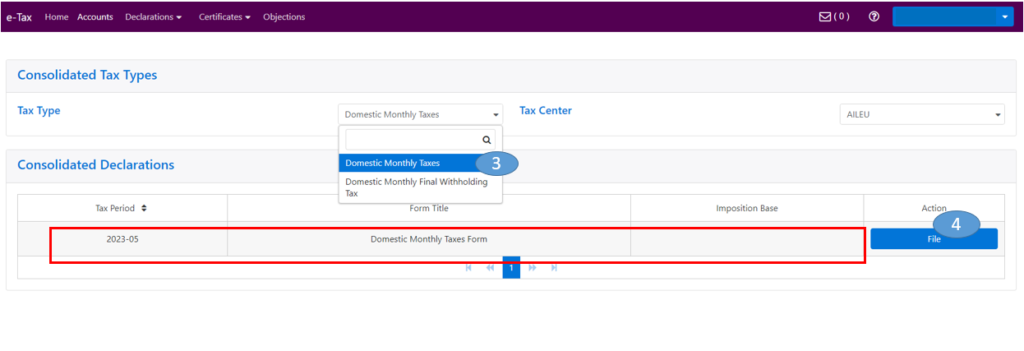

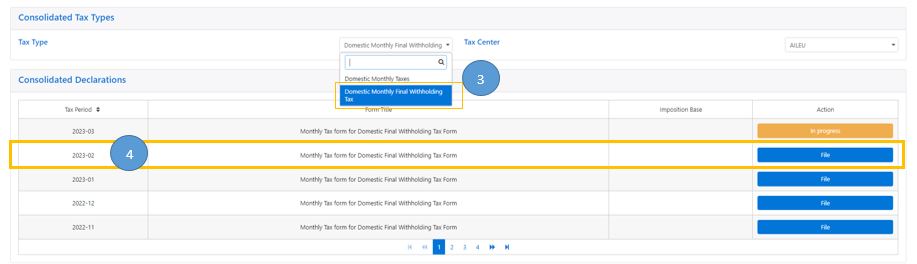

Step 1. Atu Submete Domestic Monthly Final Withholding Taxes, Klik iha Declarations iha menu no bele hare lista drop-down menu hanesan imajen.

Step 2. Klik iha Consolidated Declarations exemplu iha imagen kraik ne’e:

Step 3. Ba iha search field parte klaran uza seta navegasaun /navigation arrow no Hili Domestic Monthly Final withholding tax.

Step 4. klik File ba Tinan/Fulan neébe prefere atu submete deklarasaun mensal (Favor hili 2023-02 neé hanesan ezemplu ba matadalan ida-neé)hanesan imajen kraik ne’e;

Antes ba step 5 ita-boót sira mos hatene/kumpriende saida maka Domestic Monthly Final Withholding Tax neé akumula tipo Imposto mak ualu (8) mak hanesan:

- Domestic Withholding Prizes and Lotteries (Imposto Retensaun Premious no Loteria),

- Domestic Withholding Royalties (Imposto Retensaun Royalties),

- Domestic Withholding Rent-land and Buildings (Imposto Retensaun Aluga rai no uma),

- Domestic Withholding Construction and Building Activities (Imposto retensaun Konstrusaun no Atividade Konstrusaun),

- Domestic Withholding Construction Consulting Services (Imposto Retensaun Servisus Konsultoria ba Konstrusaun),

- Domestic Withholding Mining and Mining Support Services (Imposto Retensaun Esplorasaun Mina no Servisus ba Apoiu),

- Domestic Withholding Transportation Air and Sea (Imposto RetensaunTransporte ba Aero no Maritimu),

- Domestic Withholding Non-residents Without Permanent Establishmen (Imposto Retensaun laos Rezidente no Laiha Estabelesementu iha TL).

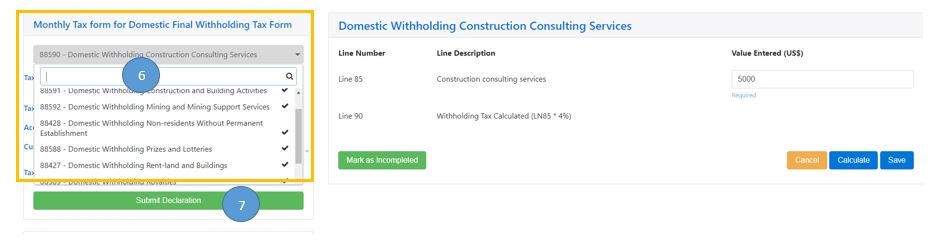

Step 5. Ba iha search field/ kampu parte karuk no uza seta navegasaun /navigation arrow hodi hili tipo Impostos/taxes iha lista drop-down menu ne’ebe ITA hakarak atu deklara /submete, Ex. iha imagen kraik ne’e.

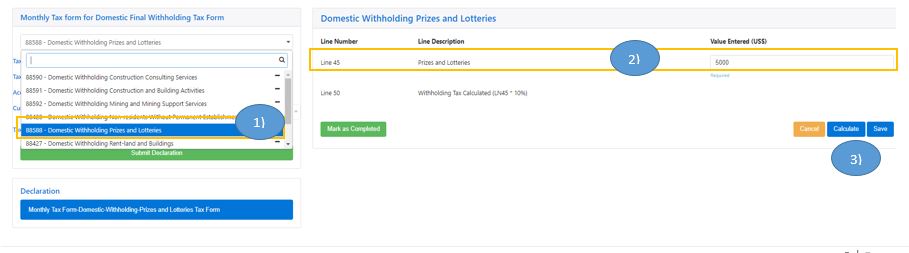

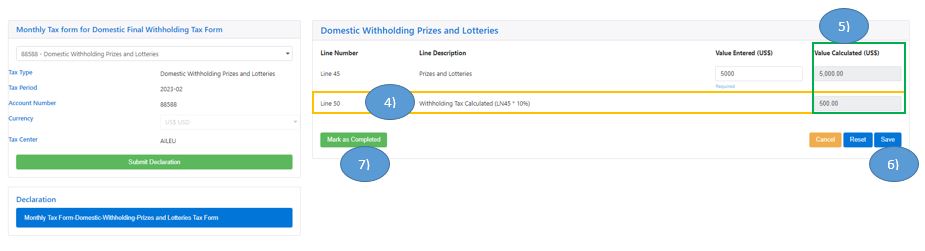

a). Domestic Withholding Prizes and Lotteries (Imposto Retensaun Premious no Loteria),

- Ba iha search field parte karuk hodi uza seta navegasaun/navigation arrow hodi hili Domestic Withholding Prizes and Lotteries

- Preenxe tuir kuluna neébe iha seksaun parte loos nian karik presiza; iha “Line 45”: insera Total Gross Prizes and Lotteries iha kuluna ($5000 hanesan ezemplu ba mata-dalan ida-neé), favor vizita / kontatu ami karik hatene liu tan informasaun.

- Klik iha calculate

- Iha “Line 50 Total Prizes and Lotteries tax withheld during the month (LN45x 10%)” sei automatically mosu wainhira klik iha Calculate Button ( $5000X10%=$500 neé hanesan ezemplu deit ba iha mata-dalan ida-neé ou ita-boót bele klik reset karik montante insera ne’e sala)

- Montante ($) valor/montante ($) iha “Line 50 Tax to Pay and Value Calculated (US$)” sei automatically mosu wainhira ITA klik iha Calculate Button ($500 hanesan ezemplu ba madalan ida-neé ou ITA bele klik reset karik montante insera ne’e sala)

- Klik Save

- Klik Mark as Completed

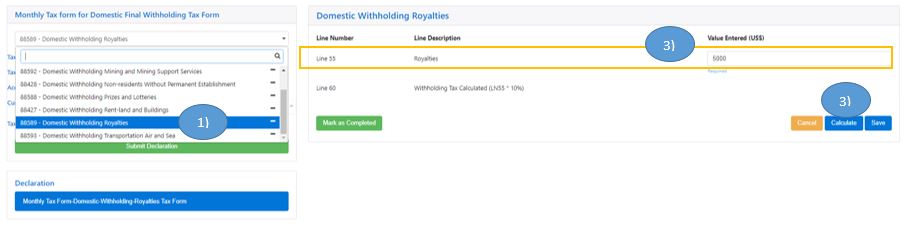

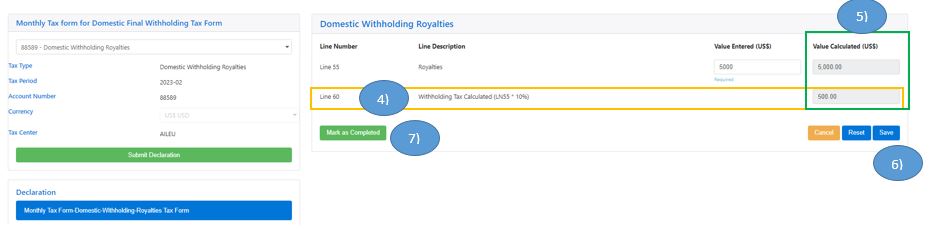

b). Domestic Withholding Royalties (Imposto Retensaun Royalties),

- Ba iha search field parte karuk hodi uza seta navegasaun/navigation arrow (Ú) hodi hili Domestic Withholding Royalties

- Preenxe tuir kuluna neébe iha seksaun parte loos nian karik presiza; iha “Line 55”: insera Total gross Royalties during the month iha kuluna ($5000 hanesan ezemplu ba mata-dalan ida-neé), favor vizita / kontatu ami karik hatene liu tan informasaun.

- Klik iha calculate,

- Iha “Line 60 Total Royalties income withheld during the month (LN55 x10%)” sei automatically mosu wainhira klik iha Calculate Button ( $5000X10%=$500 neé hanesan ezemplu deit ba iha mata-dalan ida-neé ou ita-boót bele klik reset karik montante insera ne’e sala)

- Montante ($) valor/montante ($) iha “Liñe 60 Tax to Pay and Value Calculated (US$)” sei automatically mosu wainhira ITA klik iha Calculate Button ($500 hanesan ezemplu ba madalan ida-neé ou ITA bele klik reset karik montante insera ne’e sala)

- Klik Save

- Klik Mark as Completed

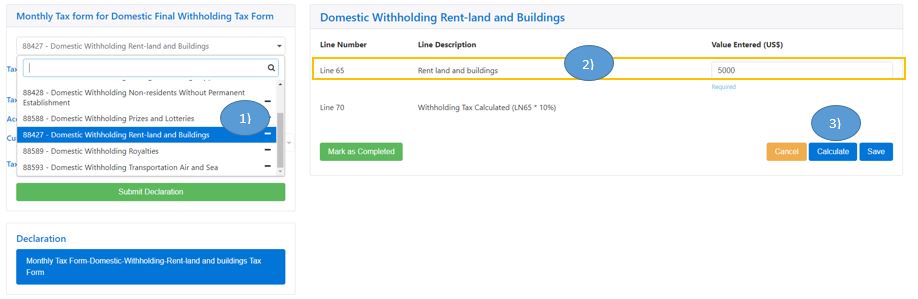

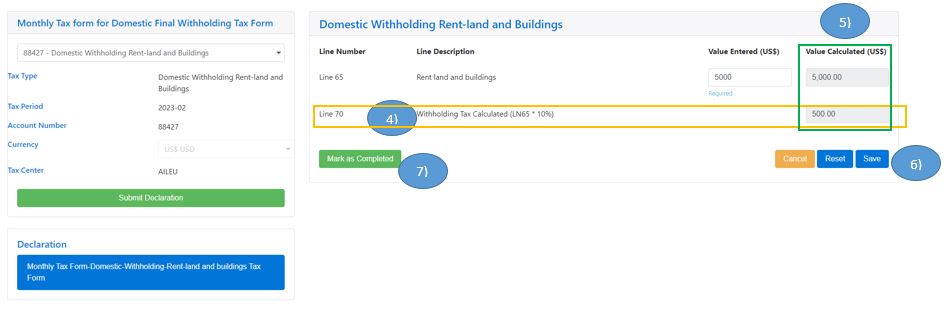

c) Domestic Withholding Rent-land and Buildings (Imposto Retensaun Aluga rai no uma),

- Ba iha search field parte karuk hodi uza seta navegasaun/navigation arrow (Ú) hodi hili Domestic Withholding Rent-land and Buildings

- Preenxe tuir kuluna neébe iha seksaun parte loos nian karik presiza; iha “Line 65”: insera Total Rent and Buliding iha kuluna ($5000 hanesan ezemplu ba mata-dalan ida-neé), favor vizita / kontatu ami karik atu hatene liu tan informasaun.

- Klik iha calculate,

- Iha “Line 70 Withholding Tax Calculated (LN65x 10%)” ” sei automatically mosu wainhira klik iha Calculate Button ( $5000X10%=$500 neé hanesan ezemplu deit ba iha mata-dalan ida-neé ou ita-boót bele klik reset karik insera montante balun sala)

- Montante ($) valor/montante ($) iha “Liñe 70 Tax to Pay and Value Calculated (US$)” sei automatically mosu wainhira ITA klik iha Calculate Button ($500 hanesan ezemplu ba mata-dalan ida-ne’e ou ITA bele klik reset karik montante insera ne’e sala)

- Klik Save

- Klik Mark as Completed

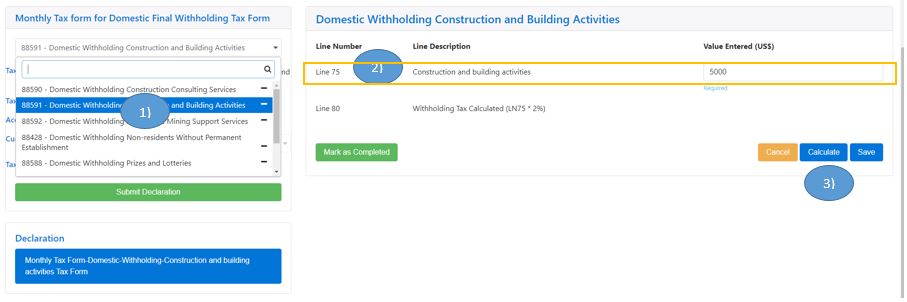

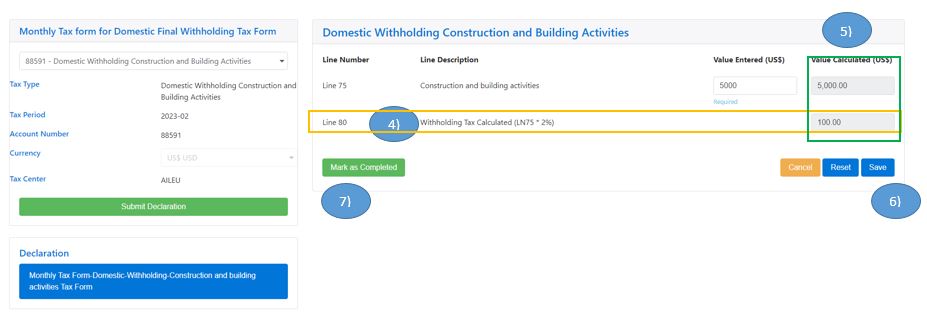

d) Domestic Withholding Construction and Building Activities (Imposto retensaun Konstrusaun no Atividade Konstrusaun)

- Ba iha search field /kampu parte karuk hodi uza seta navegasaun/navigation arrow (Ú) hodi hili Domestic Withholding Construction and Building Activities

- Preenxe tuir kuluna neébe iha seksaun parte loos nian karik presiza; iha “Line 75”: insera Total Construction and building activities paid during the month iha kuluna ($5000 hanesan ezemplu ba mata-dalan ida-neé), favor vizita / kontatu ami karik atu hatene liu tan informasaun.

- Click iha Calculate

- Iha “Line 80 Total Construction and building activities withheld during the month””(LN75 x 2%)”, sei automatically mosu wainhira klik iha Calculate Button ( $5000 x 2%=$100 neé hanesan ezemplu deit ba iha mata-dalan ida-ne’e ou ita-boót bele klik reset karik montante insera ne’e sala)

- Montante ($) valor/montante ($) iha “Liñe 75 Tax to Pay and Value Calculated (US$)” sei automatically mosu wainhira ITA klik iha Calculate Button ($100 hanesan ezemplu ba mata-dalan ida-neé ou ITA bele klik reset karik montante insera ne’e sala)

- Klik Save

- Klik Mark as Completed

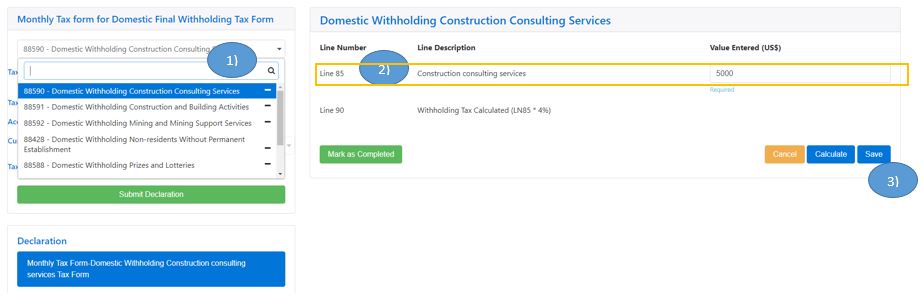

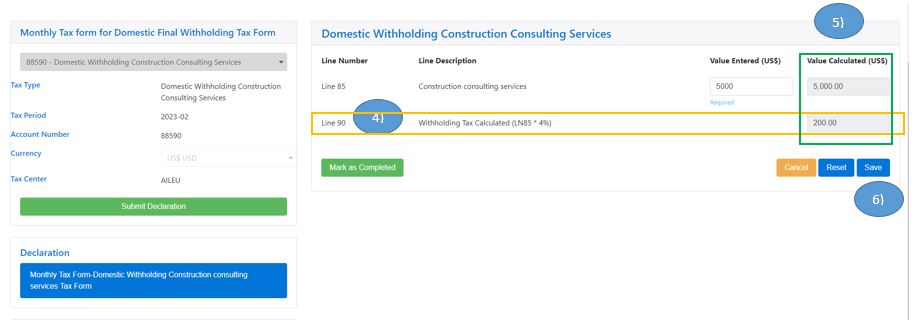

e) Domestic Withholding Construction Consulting Services (Imposto Retensaun Servisus Konsultoria ba Konstrusaun),

- Ba iha search field parte karuk hodi uza seta navegasaun/navigation arrow (Ú) hodi hili Domestic Withholding Construction Consulting Services

- Preenxe tuir kuluna neébe iha seksaun parte loos nian karik presiza; iha “Line 85”: insera Total Construction consulting services during the month iha kuluna ($5000 hanesan ezemplu ba mata-dalan ida-neé), favor vizita / kontatu ami karik atu hatene liu tan informasaun.

- Klik iha Calculate,

- Iha “Line 90 Total Construction consulting services withheld during the month”LN85 x 4 %)”, sei automatically mosu wainhira klik iha Calculate Button ( $5000X 4%=$200 ne’e hanesan ezemplu deit ba iha mata-dalan ida-neé ou ita-boót bele klik reset karik montante insera ne’e sala).

- Montante ($) valor/montante ($) iha “Liñe 90 Tax to Pay and Value Calculated (US$)” sei automatically mosu wainhira ITA klik iha Calculate Button ($200 hanesan ezemplu ba mata-dalan ida-neé ou ITA bele klik reset karik montante insera ne’e sala)

- Klik Save

- Klik Mark as Completed

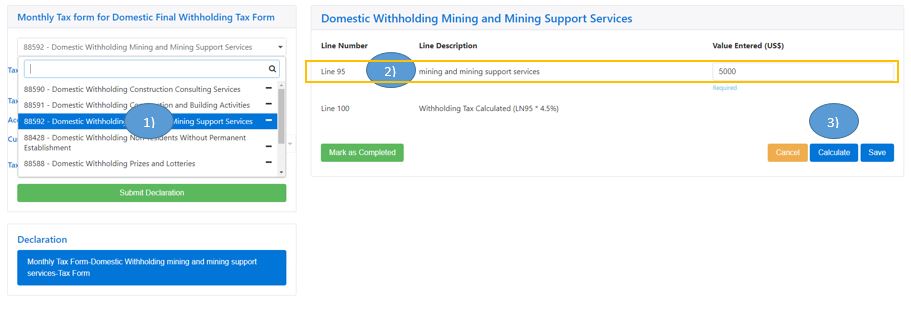

f) Domestic Withholding Mining and Mining Support Services (Imposto Retensaun Esplorasaun Mina no Servisus ba Apoiu),

- Ba iha search field/kampu parte karuk hodi uza seta navegasaun/navigation arrow (Ú) hodi hili Domestic Withholding Mining and Mining Support Services

- Preenxe tuir kuluna neébe iha seksaun parte loos nian karik presiza; iha “Line 95”: insera Total gross mining and mining support services during the month iha kuluna ($5000 hanesan ezemplu ba mata-dalan ida-neé), favor vizita / kontatu ami karik atu hatene liu tan informasaun.

- Klik iha Calculate,

- Iha “Line 100 Total mining and mining support services withheld during the month” (LN95 x 4.5%)’, sei automatically mosu wainhira ITA klik iha Calculate Button ($5000 x 4.5% hanesan ezemplu ba mata-dalan ida-neé ou ITA bele klik reset karik montante insera ne’e sala)

- Montante ($) valor/montante ($) iha “Line 100 Tax to Pay and Value Calculated (US$)” sei automatically mosu wainhira ITA klik iha Calculate Button ($225 hanesan ezemplu ba mata-dalan ida-neé ou ITA bele klik reset karik montante insera ne’e sala)

- Klik Save

- Klik Mark as Completed

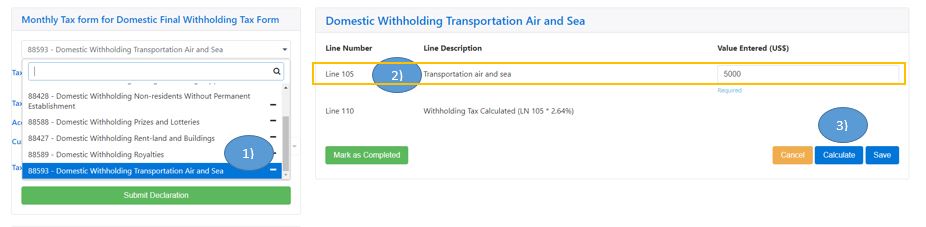

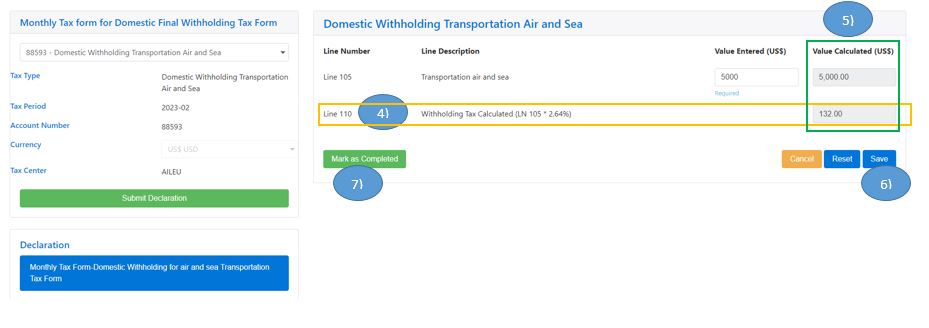

g) Domestic Withholding Transportation Air and Sea (Imposto RetensaunTransporte ba Aero no Maritimu),

- Ba iha search field parte karuk hodi uza seta navegasaun/navigation arrow (Ú) hodi hili Domestic Withholding Transportation Air and Sea

- Preenxe tuir kuluna neébe iha seksaun parte loos nian karik presiza; iha “Line 105”: insera Total gross Transportation – air and Sea the month iha kuluna ($5000 hanesan ezemplu ba mata-dalan ida-neé), favor vizita / kontatu ami karik atu hatene liu tan informasaun.

- Click iha Calculate

- Iha “Line 110 Total Transportation – air and Sea withheld during the month”(LN105 x 2.64%), sei automatically mosu wainhira ITA klik iha Calculate Button ($5000 x 2.64% hanesan ezemplu ba mata-dalan ida-neé ou ITA bele klik reset karik montante insera ne’e sala)

- Montante ($) valor/montante ($) iha “Liñe 110 Tax to Pay and Value Calculated (US$)” sei automatically mosu wainhira ITA klik iha Calculate Button ($132 hanesan ezemplu ba mata-dalan ida-neé ou ITA bele klik reset karik montante insera ne’e sala)

- Klik Save

- Klik Mark as Completed

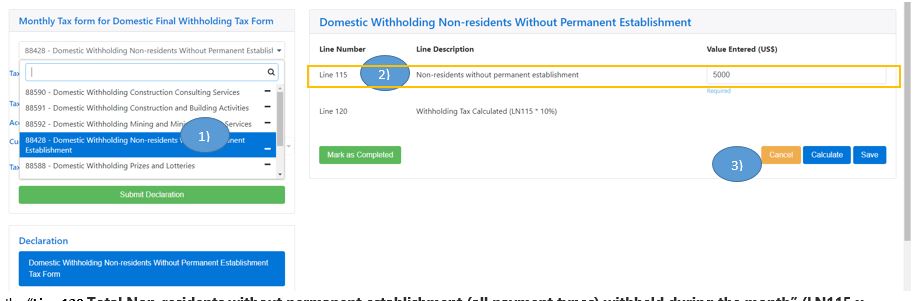

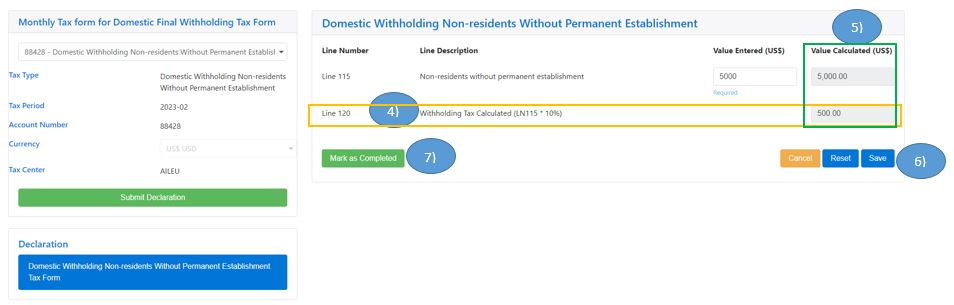

h) Domestic Withholding Non-residents Without Permanent Establishmen (Imposto Retensaun laos Rezidente no Laiha Estabelesementu iha TL)

- Ba iha search field/kampu parte karuk hodi uza seta navegasaun/navigation arrow (Ú) hodi hili Domestic Withholding Non-residents Without Permanent Establishmen

- Preenxe tuir kuluna neébe iha seksaun parte loos nian karik presiza; iha “Line 115”: insera Total Non-residents without permanent establishment (all payment types) paid during the month iha kuluna ($5000 hanesan ezemplu ba mata-dalan ida-neé), favor vizita / kontatu ami karik atu hatene liu tan informasaun.

- Klick iha Calculate,

- Iha “Line 120 Total Non-residents without permanent establishment (all payment types) withheld during the month” (LN115 x 10%)”, sei automatically mosu wainhira ITA klik iha Calculate Button ($5000 x 10% hanesan ezemplu ba mata-dalan ida-neé / ITA bele klik reset karik montante insera ne’e sala)

- Montante ($) valor/montante ($) iha “Liñe 120 Tax to Pay and Value Calculated (US$)” sei automatically mosu wainhira ITA klik iha Calculate Button ($500 hanesan ezemplu ba mata-dalan ida-neé ou ITA bele klik reset karik montante insera ne’e sala)

- Klik Save

- Klik Mark as Completed

Setp 6), Cek iha vistu/ Mark ( ü) ba Tipo Imposto akumulado/ associate ho formuláriu Domestic Monthly Final Withholding Tax form ne’ebé ita hakarak atu Deklara/ Submete.

Step 7), Klik Submit Declaration (Note: Karik iha tipu taxe balun mak seidauk Vistu, bele ba fali hodi click iha tipu taxa refere depois click iha Mark as Complete hodi bele Vistu. Tamba Butaun “Submit” sei imbizibel wainhira iha tipu taxa balun la vistu.) sistema sei messagen hanesan: (This consolidted declaration is not permitted to send to the tax center because some of its children did not yet been marked as completed:

- 88428 - Domestic Withholding Non-residents Without Permanent Establishment

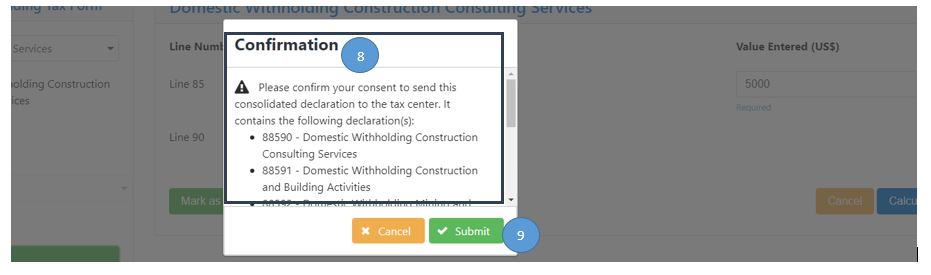

Step 8), Confirmed list of Consolidated Declaration

Step 8), Confirmed list of Consolidated Declaration

Step 9), klik Submit. Husu konfirma antes finalize submisaun deklarasaun no sistema aloka Aumatimente numeru avalisaun/Assessment number kada tipo impostu ho numeru uniku deklarasaun/ a unique declaration number.

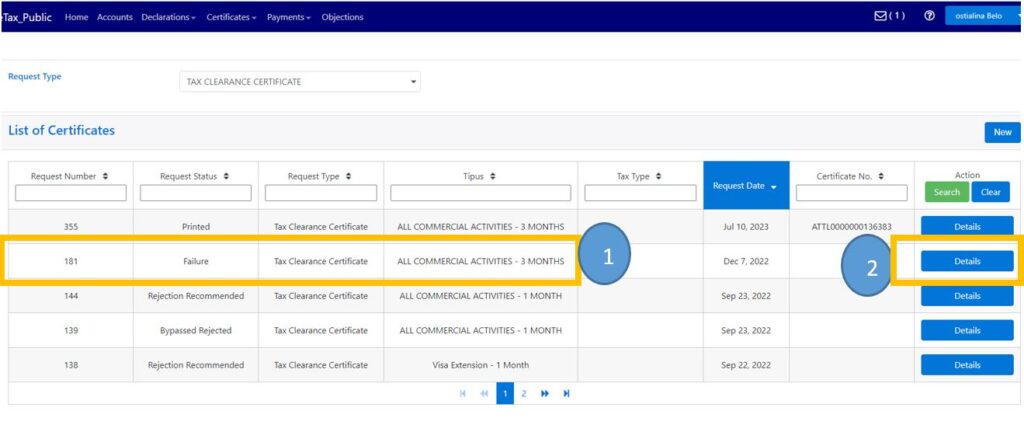

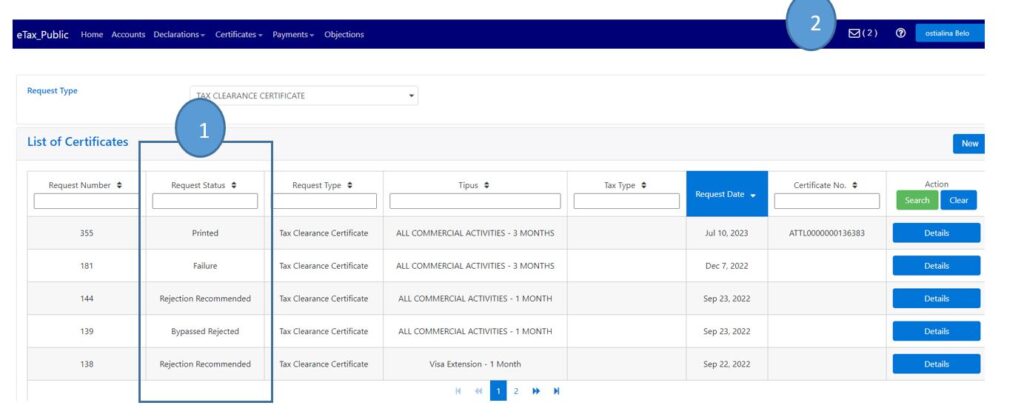

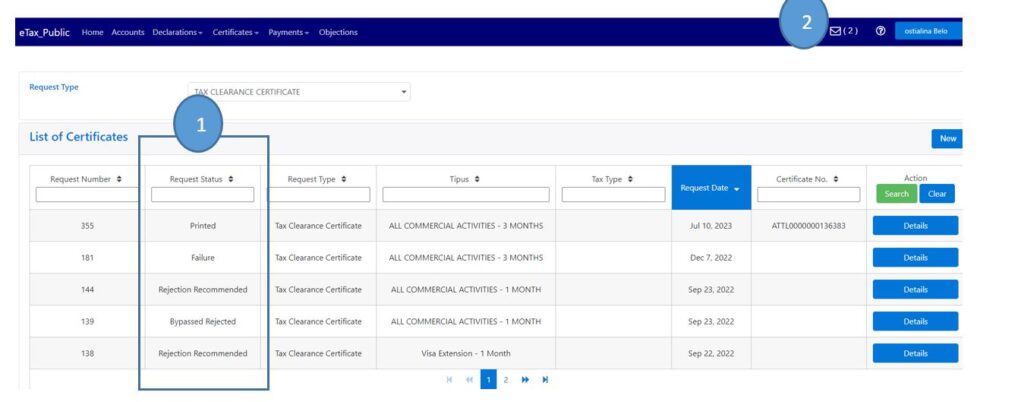

- Ita hili Request number 181 hanesan exemplu ba matadalan ida ne’e

- Klik Details iha action nia okos atu cek nia validasaun ba Sertidaun Dividas ne’ebe ho Request Status “Failure” ho detallu deskripsaun.

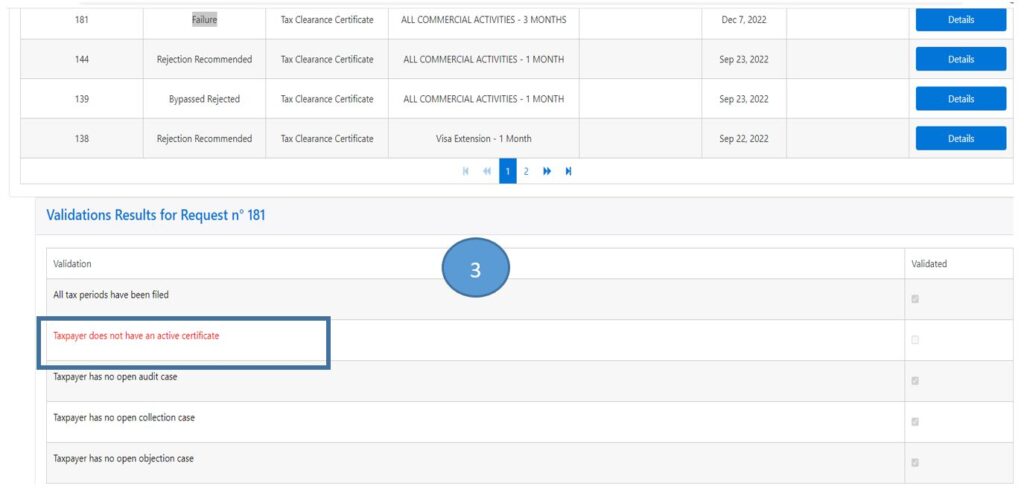

- Wainhira pontu validasaun sira iha kraik ne’e balun mak ho KOR MEAN ne’e signifika katak kompania refere iha problema no Sertidaun Dividas la bele sai, Ba validaaun nune’e presiza mai Autoridade Tributária hodi resolve antes halo fali pedidu ba Sertidaun Dividas Foun, detallu validasaun mak hanesan tuir mai:

Deskripsaun Detallu ba kada Validasaun iha leten:

-

All tax periods have been filed :ne’e katak atu hare periudu/ submisaun deklarasaun impostu mensal no annual rutina ho ordem no kompletu,

-

Taxpayer does not have an active certificate : ne’e katak Sertidaun dividas ne’e sai validu hela no la premite emite Sertidaun dividas foun, Dividas mate ohin aban mak halo pedidu, tanba Sertidaun dividas wainhira halo pedidu iha kualker tempu no kumpri hotu validasaun sira lori maksimu 20 minutus Automatik haruka empreza sem interven husi ofisial AT,

-

Taxpayer has no open audit case : ne’e katak iha prosesu Audit registu hela no seidauk finalize servisu husi parte Diresaun Nasional Inspesaun Tributária (DNIT-AT),

-

Taxpayer has no open collection case : ne’e katak registu hela parte kobransa nian no seidauk finalize servisu husi Kobransa Diresaun Nasional Receitas Domestica (DNRD no DNPM – AT),

-

Taxpayer has no outstanding liabilities : ne’e katak sei iha Dividas ba Estado no presiza kumpri antes halo pedidu ba Sertidaun dividas,

-

Taxpayer respects all payment agreements : ne’e katak regista hela iha akordo pagamentu impostu ho Autoridade Tributária,

-

Taxpayer CD HOLD Placed : ne’e katak iha identifikasaun balun husi AT presiza mai AT hodi resolve antes halo pedidu ba Sertidaun dividas,

-

Taxpayer no any Tax Accounts : ne’e katak durante ne’e la halo deklarasaun mensal no annual impostu nian mai AT, presiza mai AT hodi konfirma antes halo pedidu ba Sertidaun dividas.

- Click iha ne'e karik hakarak Download PDF Version

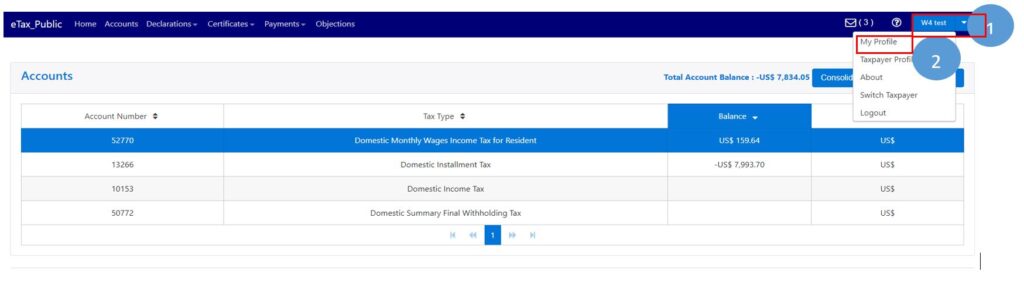

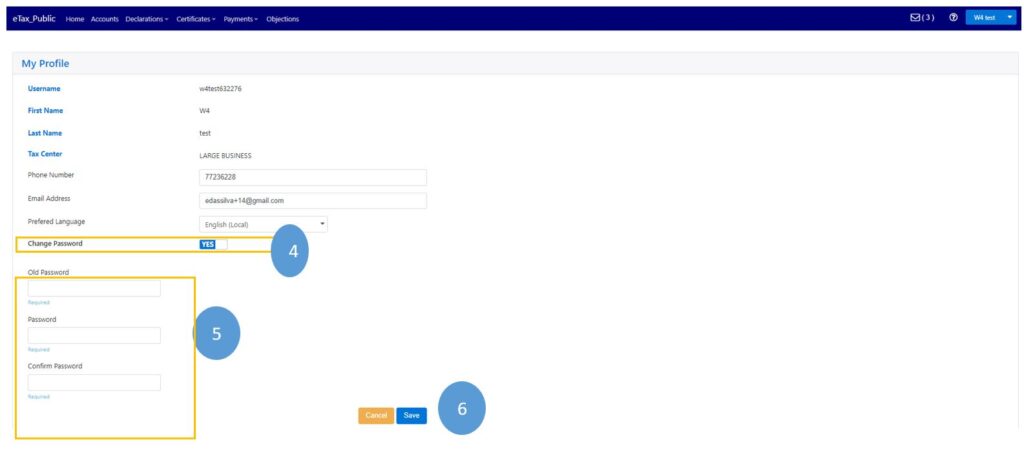

- Click on the arrow in the Profile menu, in the top right corner of the toolbar;

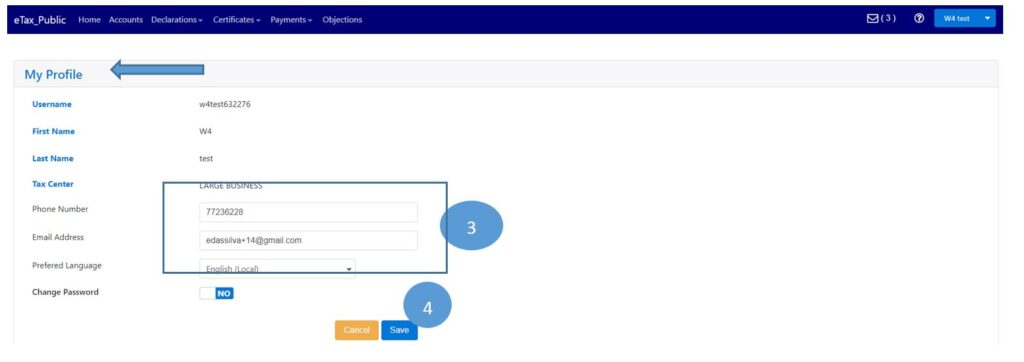

- Click on the My Profile This action opens the My profilepage;

- Change your Phone Number, Email Addressor Preferred Language at your will.

- Click on Save. This action updates your profile information

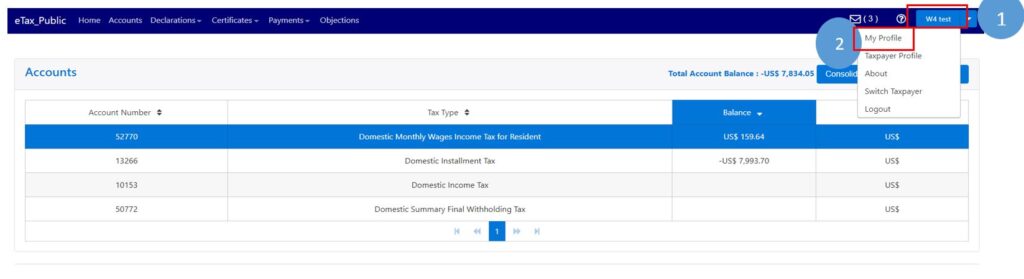

- Click the arrow next to your name in the top right corner of the toolbar;

- Select the option My Profile. This action opens the My Profilepage;

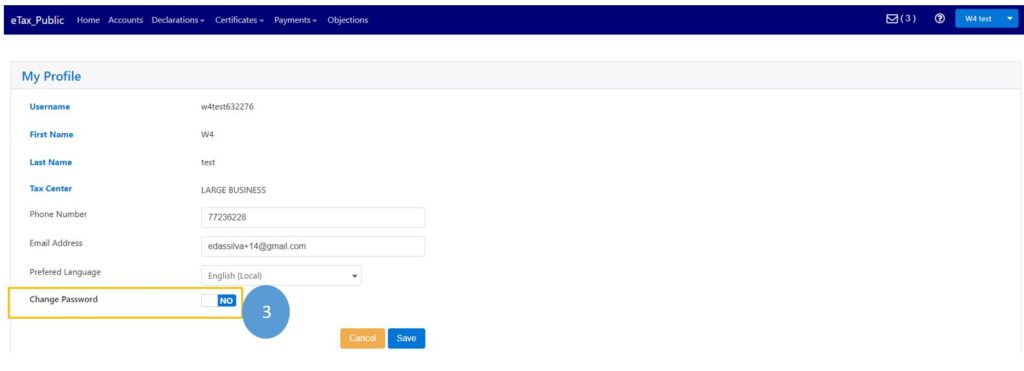

- Go to the field Change Passwordand drag the mouse from the No tab to the left until it changes to YES. This action displays the fields necessary to change the password;

- When successfully drag the mouse from the Notab to the left until it changes to YES. This action displays the fields necessary to change the password;

- Fill out the Old Password, the new Password at you will , Confirm Passwordfields;

- Click the Save This action updates your profile and password.

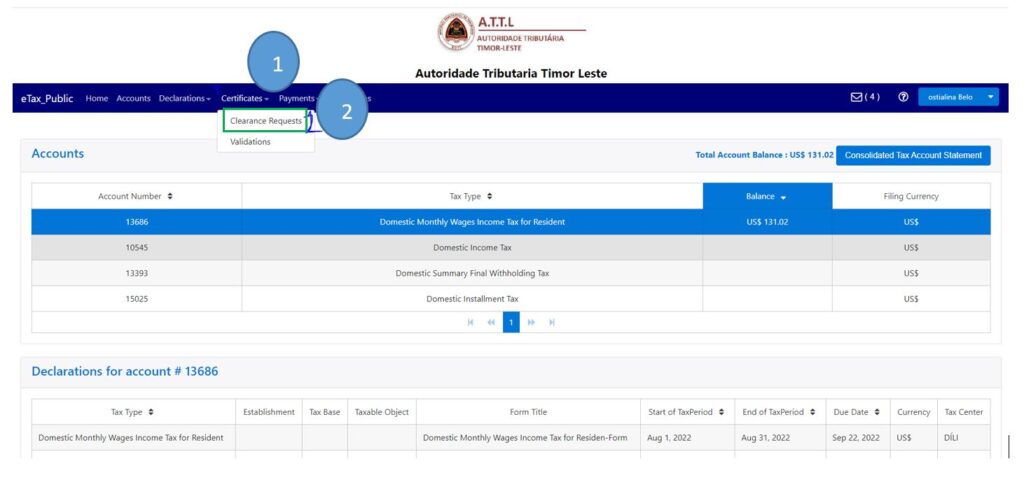

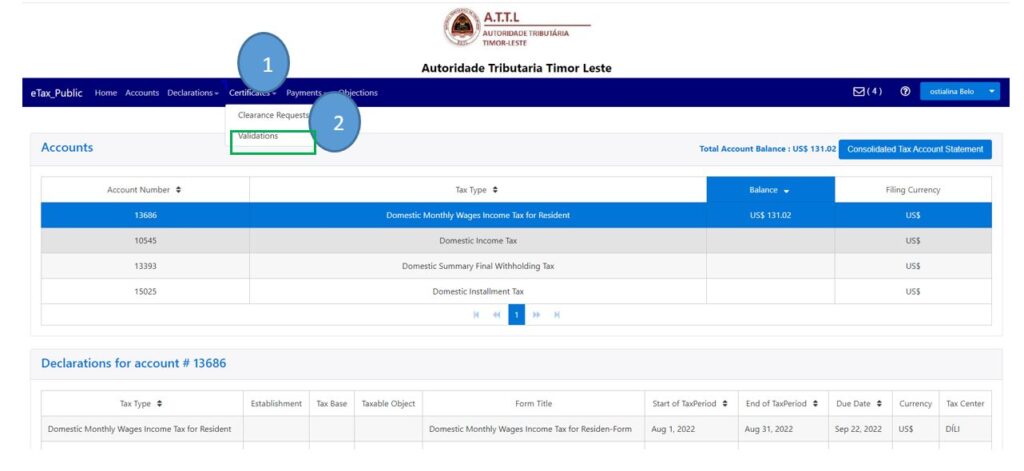

I. Oinsa Halo Pedidu

- Klik iha Module “Certificate” iha Menu hodi display/hatudu lista opsaun

- Klik iha “Clearance Request”,

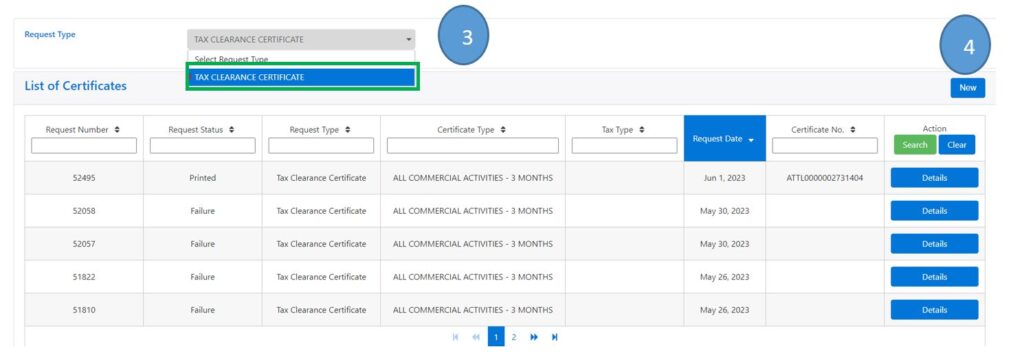

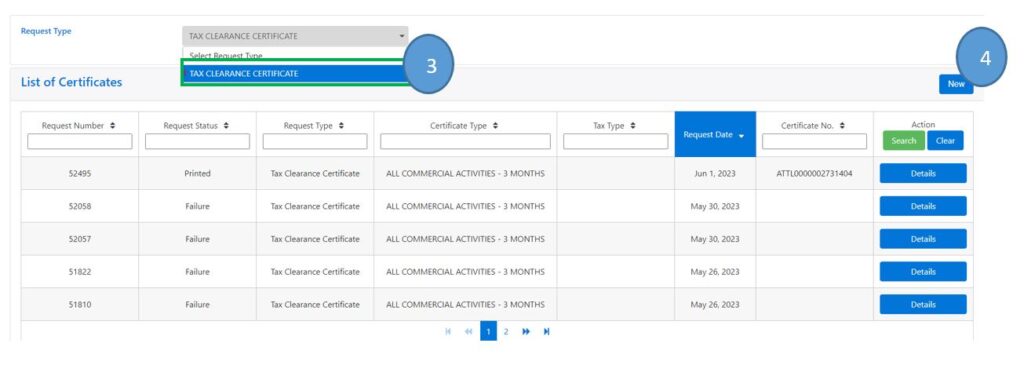

- Klik arrow Request Type depois hili Tax Clearance Certificate

- Klik “New” atu halo pedidu Sertidaun Dividas

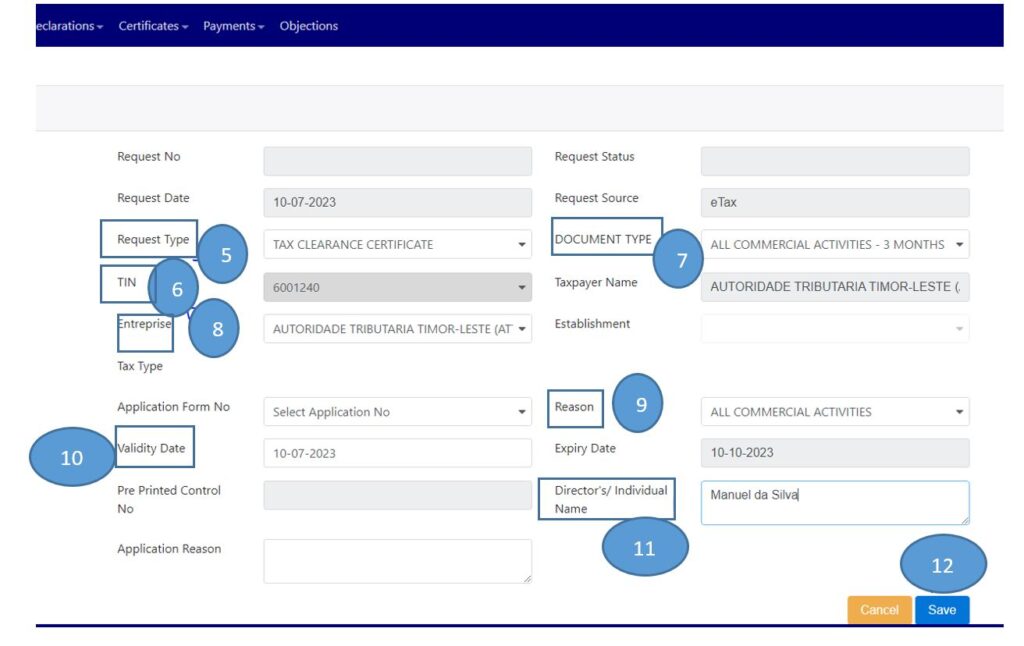

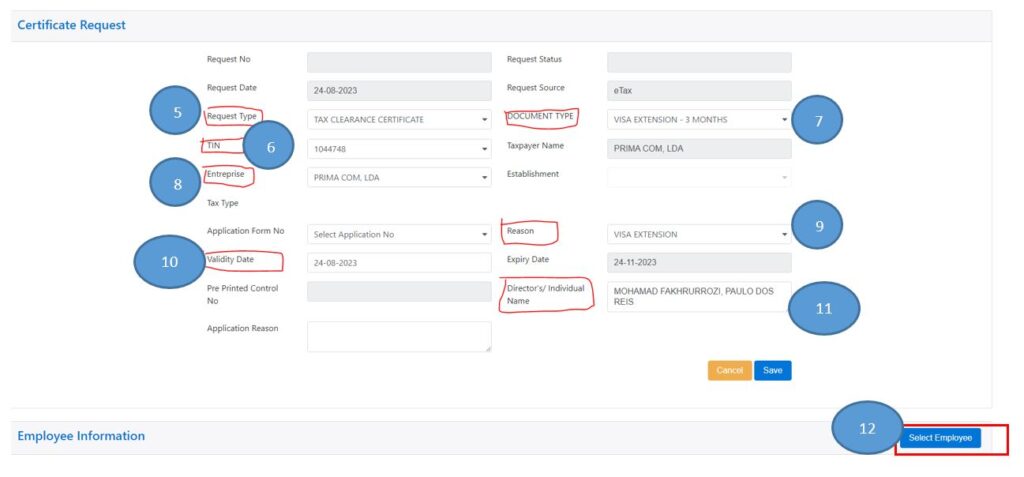

- Iha Request Type: Tax Clearance Certificate

- Klik arrow TIN: automatic display/ mosu TIN ne’ebe registado iha SERVE IP no AT no hili

- Klik arrow DOCUMENT TYPE: Tipu Dokumentus ba Sertidaun Dividas hamutuk ha’at (4) mak hanesan:

- All Commercial Activities- 3 Months,

- All Commercial Activities- 1 Month,

- Viza Extension- 3Months,

- no, Viza Extension 1 Month.

- Klik arrow Enteripes: automatic display/ mosu empreza nia naran ne’e registado iha SERVE.IP no iha AT no: hili

- Klik arrow “Reason”: hili ALL COMERCIAL ACTIVITIES / EXTENSION VISA

- Klik “Validity Date” hili date emite ohin Loron Sertidaun Dividas , no Expiry Date sei automatca mosu

- Hakerek Kompletu director ba empreza nia naran iha koluna “Director's/ Individual Name”

- Klik Save: Depois klik ”Save” sei lori minutu balun hodi sistema sei automatic generate Sertifikadu Sertidaun Dividas ou Rejection, depende ba lina koneksaun internet.

II.Oinsa Imprime Certidaun Devidas

Atu Imprime Certidaun Devidas, ita Cek uluk “Status Request: Printed, Failure, Rejection Recommended”.-

- Se status Printed: Kontinua ho Etapa tuir-mai (Etapa Segundu)

- Se Status Failure: Bele hare rasik madadalan Oinsa Atu Cek Sertidaun Dividas ho Request Status “Failure”.

- Se Status mak Rejection Recommended: tenki Komunika ho Kobransa Diresaun Nasional Receitas Domestica (DNRD no DNPM – AT),

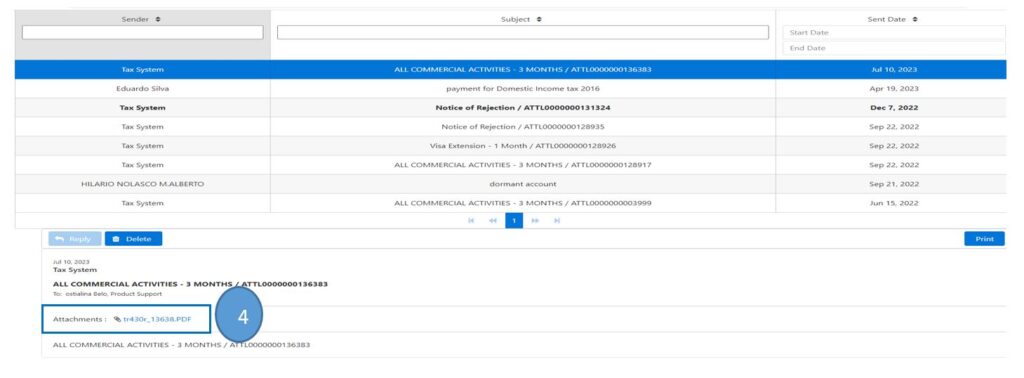

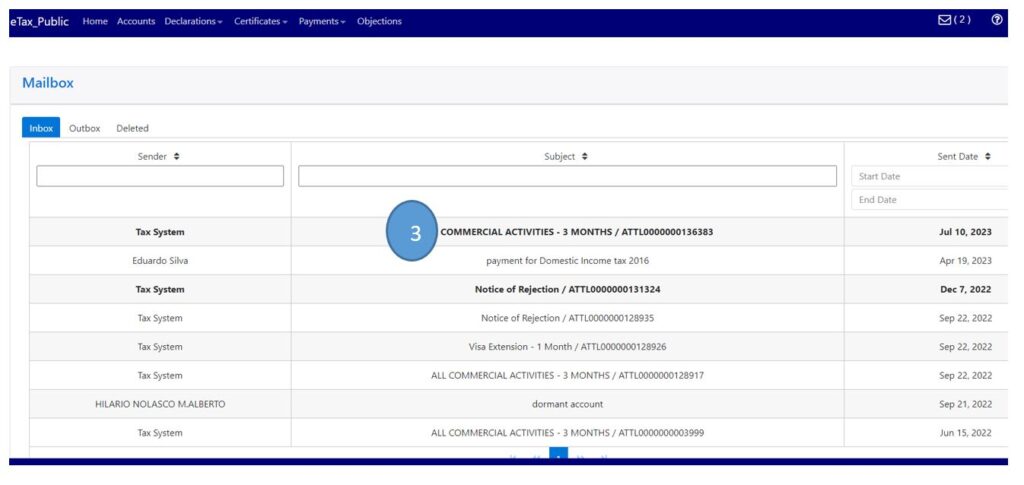

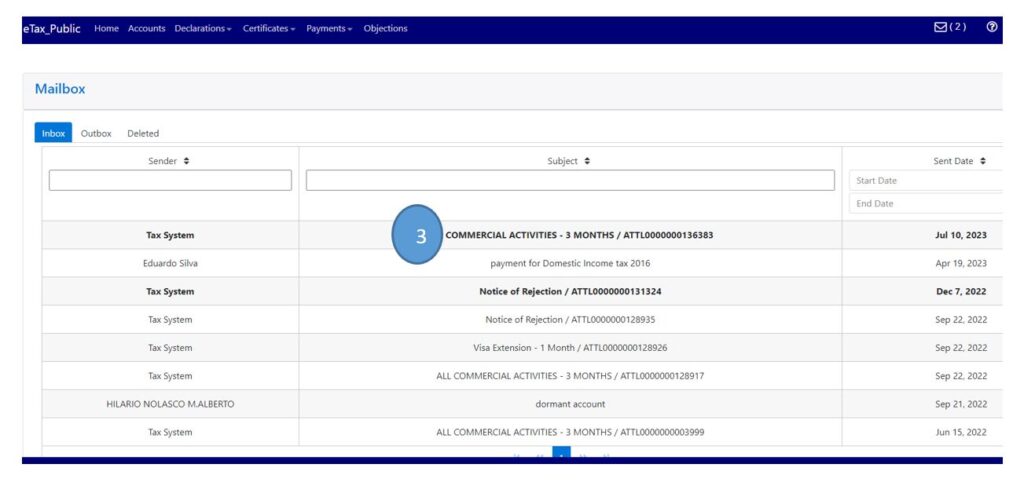

- Clik Mailbox

(Inbox)

(Inbox)

- Click iha All Commercial Activities-3 Months (Depois dada Tun ba kriak Download file refere).

Halo favor tuir Step 15 ne’ebe mak hanesan tuir mai ne’e:

- Step 1) Klik iha Module “Certificate” iha Menu hodi display/hatudu lista opsaun

- Step 2) Klik iha Clearance Request,

- Step 3) Klik arrow Request Type depois hili Tax Clearance Certificate

- Step 4) Klik “New” atu halo pedidu Sertidaun Dividas

“Note Importante”

Antes ba Step 5, tenki kompreden katak Tipu Documentus ba Cetidaun Devidas hamutuk ha’at (4) mak hanesan: All Commercial Activities- 3 Months, All Commercial Activities- 1 Month, Viza Extension- 3 Months, no Viza Extension-1 Month. Hili tuir ita-bo’ot sira nia necesidade Kompaña. All commercial Activities mak Devidas ba Atividades hotu ne’ebé relasiona ho kompaña, no Viza Extenison ne refere ba Devidas Individual liliu ba pessoal estranjeiru sira ne’ bé presija atu halo vistu servisu ou extende sira nian Vistu de Servisu (Working Viza). Toma nota mos ba ita bo’ot sira hotu katak Devidas fulan 1 ba All Commercial Activities- 1 ou Month, Viza Extension-1 Month ne’e presija nafatin koordenasaun / komunikasaun ho ofisial Autoridade Tributária hodi hetan approvasaun tanba presija justifikasaun ne’ebé resonabel.- Step 5) Iha Request Type: Tax Clearance Certificate

- Step 6) Klik arrow TIN: TIN sei automatic display/ mosu ne’ebe registado iha SERVE IP no AT.

- Step 7) Klik arrow DOCUMENT TYPE: Tipu Dokumentus ba Sertidaun de Devidas hamutuk ha’at (4) mak hanesan: iha ne;e ita-bo’ot hili

-

-

- All Commercial Activities- 3 Months,

- All Commercial Activities- 1 Month,

- Viza Extension- 3Months,

- No, Viza Extension 1 Month.

-

- Step 8) Klik iha arrow Enteripes: naran empreza sei automatic display/ mosu basea naran registado iha SERVE.IP no iha AT.

- Step 9) Klik arrow Reason: depois hili EXTENSION VISA

- Step 10) Klik “Validity Date” hili date emite ohin Loron Sertidaun Dividas, no Expiry Date sei automatica mosu

- Step 11) Hakerek Naran Kompletu director ba empreza iha kolum Director's/ Individual Name (MOHAMAD FAKHRURROZI, PAULO DOS REIS hanesan exemplu ba matadalan ida ne’e)

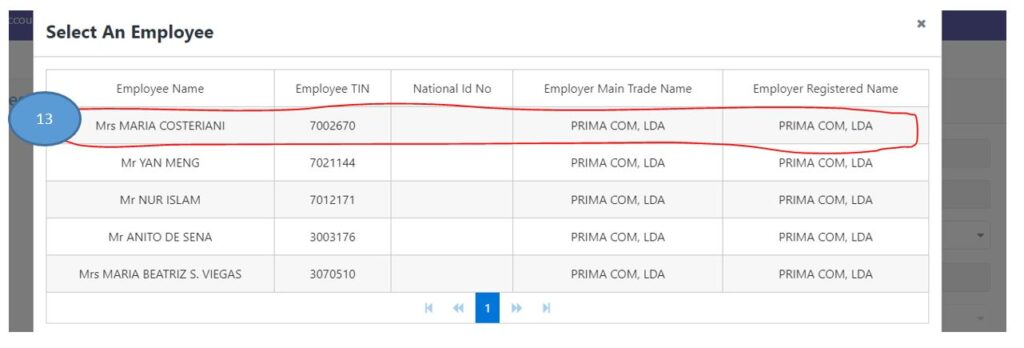

- Step 12) Click iha Select Employee: sei mosu tabela list employee atu hili (hare etapa 13)

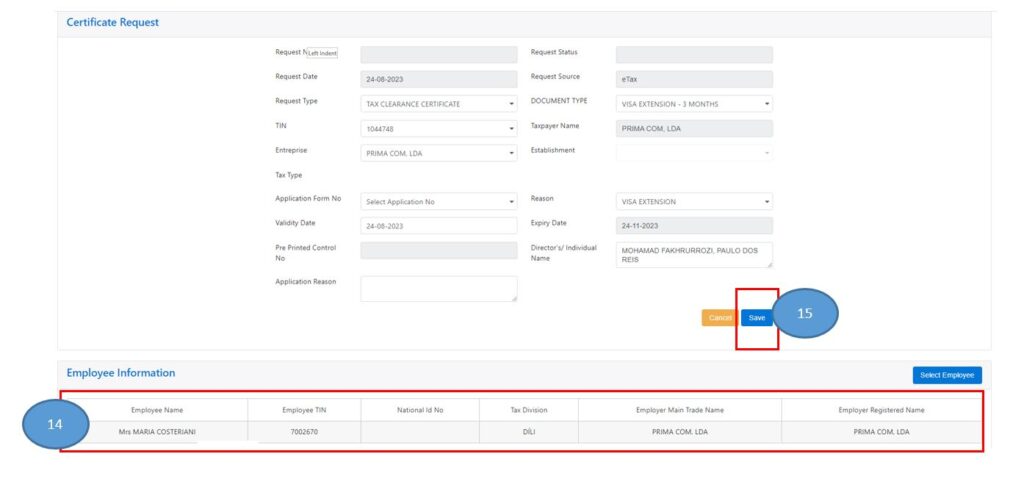

- Step 13) Hare lista employere hodi hili no click ba specifiku Individual ou pessoal ne’ebé atu husu devidas. Iha ne’e, ita hili no click Mrs MARIA COSTERIANI hanesan exemplu iha matadalan ida-ne’e

- Step 14) Verifika (Cross Check) ba Naran pessoal spesifiku nebe Akresenta (add) iha Employee Infromation atu husu devidas ne’e

- Step 15) Klik Save: Depois klick save, Sistema sei automatic generate Sertifikadu Dividas ou Rejection. Nota mos katak lina koneksaun Internet bele impaktu tanba ne’e sei lori minutu balun hodi sistema bele halo validasaun.

Oinsa Imprime Sertidaun de Devidas halo tuir Step 5 hanesan tuir mai

Step 1) Atu Imprime Sertidaun de Devidas, ita Check uluk “Status Request: Printed, Failure, Rejection Recommended”.

Oinsa Imprime Sertidaun de Devidas halo tuir Step 5 hanesan tuir mai

Step 1) Atu Imprime Sertidaun de Devidas, ita Check uluk “Status Request: Printed, Failure, Rejection Recommended”.

- Se Request Status Printed: Kontinua ho Etapa tuirmai (Etapa Segundu)

- Se Request Status Failure: Bele hare rasik madadaln Oinsa Atu Cek Sertidaun Dividas ho Request Status “Failure”.

- Se Reques Status mak Rejection Recommended: tenki Komunika ho Kobransa Diresaun Nasional Receitas Domestica (DNRD no DNPM – AT) hodi hetan approvasaun

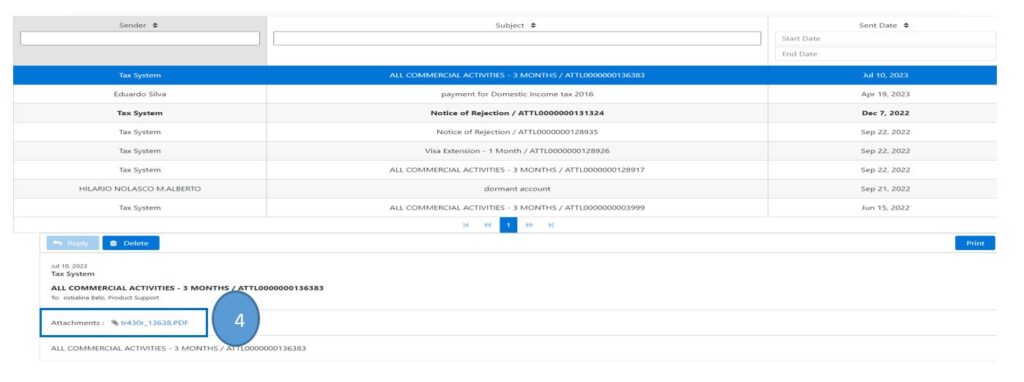

Step 3) Click Iha All Commercial Activities-3 Months (Depois dada Tun ba kriak Download file refere).

Step 3) Click Iha All Commercial Activities-3 Months (Depois dada Tun ba kriak Download file refere).

Step 4) Click Blue Hyperlink tr430r_1363.PDF (ita nian nu sei differente) atu Download Sertidaun Dividas.

Step 4) Click Blue Hyperlink tr430r_1363.PDF (ita nian nu sei differente) atu Download Sertidaun Dividas.

Step 5) Output Sertidaun Dividas

Step 5) Output Sertidaun Dividas

-

Click here Tetun Version if you want to download PDF version

- Tetun Version